Employer-provided health insurance typically continues during short-term disability but may not during long-term disability; individuals may then need to explore options like COBRA or individual health plans. Employers are not generally required to pay for health insurance during long-term disability.

Dealing with long-term disability raises critical questions about health insurance coverage. As employees transition from short-term to long-term disability, the responsibility for health insurance often shifts from the employer to the individual. This pivotal change means those on long-term disability must navigate their health insurance plans.

Options may include extending employer coverage through COBRA, seeking government-supported insurance through Medicaid or Medicare, or purchasing a private health insurance policy. Understanding and planning for this transition are essential to maintaining comprehensive health coverage during a period when medical care is crucial. With the right approach, individuals can secure the coverage necessary to support their health needs while managing long-term disability.

Introduction To Long-term Disability Insurance

Imagine your income stops due to a sudden illness or injury. Long-term disability insurance can be a financial lifesaver. It provides you with a portion of your earnings if you’re unable to work for an extended period.

The Purpose Of Long-term Disability Benefits

Long-term disability insurance is designed to help when you can’t earn a paycheck. It ensures financial stability despite unexpected life changes.

- Protection for your income: It replaces a significant part of your salary.

- Peace of mind: It offers security, allowing you to focus on recovery.

- Coverage for various conditions: It includes accidents and illnesses that limit your work ability.

Common Misconceptions About Disability Insurance

| Misconception | Reality |

|---|---|

| “My job is low-risk, I don’t need it.” | Disability can happen to anyone, regardless of occupation. |

| “Government benefits are enough.” | Social Security Disability Insurance (SSDI) can be hard to qualify for and might not match your needs. |

| “I have savings to cover disabilities.” | Savings can deplete quickly; insurance provides continuous support. |

Credit: cck-law.com

The Employee’s Guide To Health Insurance Benefits

Understanding health insurance benefits during long-term disability is crucial. This guide simplifies the process for employees navigating through these challenging times. Key information including maintenance of health insurance benefits and impact on the existing coverage when unable to work is covered here.

Keeping health insurance active while on disability can be stressful. Employees have options to retain their benefits.

- Employer-Provided Coverage: Some companies continue providing health coverage during disability periods.

- COBRA: This federal law allows you to continue your employer’s insurance for a limited time.

- State Laws: Certain states offer additional rights regarding health insurance during disability.

Employees should check the specific terms of their company policy. They may need to contribute to the premium costs to keep the insurance active.

Your health benefits could change if you’re not able to work. Here’s what might happen:

| Scenario | Health Insurance Status |

|---|---|

| Short-Term Disability | Employer may maintain coverage based on policy details |

| Transition to Long-Term Disability | Options like COBRA may become necessary for continued coverage |

| No Disability Plan | Health insurance might lapse; state or federal marketplace coverage is an option |

Early communication with your employer’s HR department is key to understanding the fate of your health benefits. Proactively manage your insurance and stay informed of changes.

Employer-sponsored Health Insurance Options

If you’re grappling with a long-term disability, you may wonder about your health insurance options. Understanding employer-sponsored health insurance is crucial during this challenging time. Stay informed about how coverage continues and who foots the bill.

Employer’s Role In Continuing Health Coverage

When you’re on long-term disability, your employer may still play a significant role in your health coverage. Here’s what you need to know:

- Continuation of Benefits: Some employers may extend health insurance coverage for a set period while you are on disability leave.

- COBRA: Under the Consolidated Omnibus Budget Reconciliation Act (COBRA), you might have the option to keep your employer’s health insurance at your own cost for a limited time.

- Cost Contribution: Employers can vary in how much they contribute to your premiums during disability. Confirm these details directly.

Navigating Health Insurance Under Employee Benefits Laws

Navigating health insurance during long-term disability involves understanding your rights under the law:

| Law | Description | Your Right |

|---|---|---|

| COBRA | Allows you to extend your employer’s plan for a limited time post-employment. | Continue your coverage by paying the full premium. |

| ADA | The Americans with Disabilities Act protects workers with disabilities. | Request reasonable accommodation, including benefits continuance. |

| HIPAA | Health Insurance Portability and Accountability Act ensures privacy and limits exclusions for pre-existing conditions. | Maintain privacy of your medical information and secure health insurance without being denied for past conditions. |

Government Disability Programs And Health Coverage

Understanding health insurance options can seem tough when you’re on long-term disability. Government programs may help. They offer health coverage to those who qualify. Let’s look at two major programs: Medicare and Medicaid. Each one has its system for aiding disabled individuals.

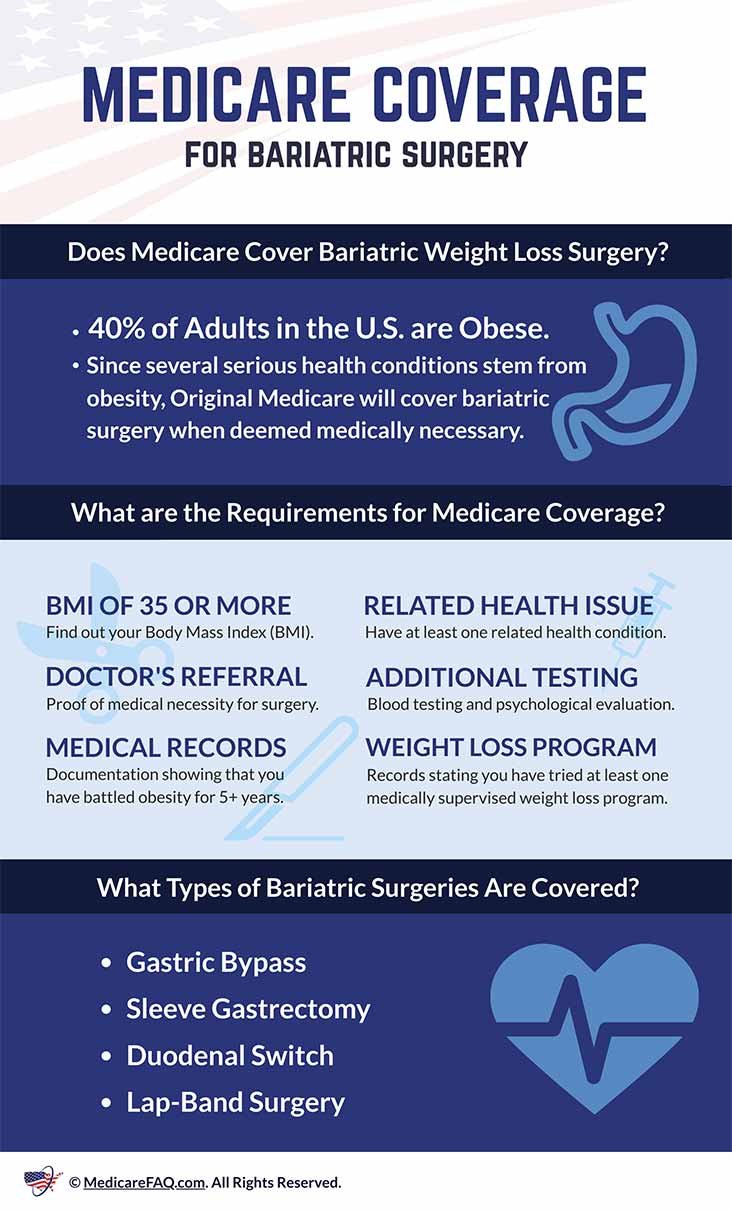

Medicare Eligibility Alongside Disability

Medicare is a federal program. It’s for people 65 and older. It’s also for certain younger people with disabilities. If you receive Social Security Disability Insurance (SSDI), you may get Medicare. But there’s a wait. The coverage starts 24 months after you get SSDI benefits. Let’s see who’s eligible:

- People under 65 with specific disabilities

- People with End-Stage Renal Disease (permanent kidney failure)

- Those with Amyotrophic Lateral Sclerosis (ALS), also known as Lou Gehrig’s disease

SSDI recipients must wait two years for Medicare. ALS patients get it immediately. Kidney failure patients must meet dialysis or transplant requirements.

How Medicaid Supports Low-income Disabled Individuals

Medicaid is a joint federal and state program. It helps with medical costs for some people with limited income and resources. Medicaid’s benefits vary by state. But, they often cover services Medicare may not. These include long-term care and personal care services.

Eligibility depends on income and disability. Each state has different rules. But, Medicaid usually covers those who get Supplemental Security Income (SSI). Here’s who might get Medicaid:

| Eligibility Group | Typical Qualifications |

|---|---|

| Low-income adults | Income below a certain level from work or no work |

| Children | Must be considered disabled by Social Security standards |

| Pregnant women | Different states have different income requirements |

Insurance Law And Long-term Disability

Insurance law plays a vital role in determining health insurance provisions for those on long-term disability. When an individual becomes disabled and unable to work, understanding the legalities surrounding their health coverage is crucial. We will explore key aspects such as COBRA and state-specific laws.

Understanding Cobra For Continuing Insurance

The Consolidated Omnibus Budget Reconciliation Act (COBRA) allows workers to keep their company health insurance after leaving a job. This is crucial when facing long-term disability.

- COBRA offers 18 to 36 months of coverage.

- Individuals pay the full premium, which can be high.

- It ensures no gap in healthcare coverage.

It’s imperative to act quickly, as there is a short window to elect COBRA coverage.

State Laws Affecting Disability And Health Insurance

Different states have unique laws governing disability and health insurance. Some may offer additional protections beyond federal standards.

| State | Law | Protection |

|---|---|---|

| New York | Disability Benefits Law | Health coverage extension |

| California | Cal-COBRA | Extends COBRA benefits |

| New Jersey | Individual Health Coverage Program | Affordable options |

Ensuring compliance with state-specific regulations can secure health benefits during long-term disability.

Private Disability Insurance Policy Breakdown

Understanding your long-term disability coverage can be puzzling. Especially when it comes to health insurance responsibilities. A deep dive into your private disability insurance policy can clarify who keeps the health insurance light shining during challenging times. Let’s split the fine print and get straight to the essentials of health coverage while on long-term disability.

Deciphering Your Policy’s Stance On Health Coverage

Reading your disability policy is like navigating a maze in the dark, but essential. The policy dictates if and how health insurance premiums are paid. Examine your policy closely for specific terms. Look for phrases like “continuation of benefits” and “health insurance premiums.” These sections provide info on health coverage while on disability.

The policy may outline situations where the insurer will pay premiums. Some policies maintain coverage as part of your benefits. Others might not cover it at all. Understanding these details ensures you’re never caught off-guard.

Individual Vs. Group Disability Insurance Differences

Knowing whether you have an individual or group policy is crucial. Here’s why:

- Individual policies: Purchased privately. Often, have more flexibility in terms. They usually don’t cover health insurance premiums.

- Group policies: Offered by employers. May provide health premium payments during disability.

With group policies, the employer might play a role in health coverage. Some companies pay health premiums for disabled employees. Your employment benefits package often highlights such perks.

In contrast, individual policies hinge on contract specifics. You need to check the policy or speak with an insurance agent for details.

| Insurance Type | Health Premium Coverage |

|---|---|

| Individual Disability Insurance | Usually Not Covered |

| Group Disability Insurance | Often Covered |

Navigating Policy Agreements And Fine Print

Understanding the specifics of health insurance coverage during long-term disability can be daunting. Many find themselves lost in a maze of policy agreements and the fine print. This section of the blog aims to throw light on the pertinent details and terms of your disability insurance policy, and the steps necessary to ensure your health coverage remains steadfast during a period of disability.

Key Terms In Your Disability Insurance Policy

Grasping the language of your insurance documents is vital. Here is a breakdown of key terms one should be familiar with:

- Benefit Period: The length of time during which benefits are paid.

- Elimination Period: The waiting time before benefits begin.

- Own Occupation vs. Any Occupation: Definitions affecting eligibility for benefits based on the ability to work.

Review these terms in your policy’s declaration page. This page outlines coverage, periods, and premiums.

Avoiding Pitfalls In Health Coverage During Disability

Navigate health coverage during a disability with care:

- Check if your employer’s plan covers disability.

- Determine whether you need to continue premiums during disability.

- Be aware of time limits for filing claims.

Analyze policy terms before signing. Consider consultation with an insurance expert. Maintain documented correspondence with your insurance provider.

| Action | Reason |

|---|---|

| Review your policy annually | To keep up with changes in terms or coverage |

| Keep records updated | For seamless claims processing |

| Clarify coverage continuity | To understand how long health insurance remains active |

Credit: cck-law.com

The Financial Impact Of Disability On Healthcare

Getting sick or hurt can change your life in many big ways. One of those changes is often in how you handle money for doctor bills. When you can’t work for a long time, you might wonder who helps pay for these bills. This can make a hard time even tougher. Let’s talk about how to manage healthcare costs when you have less money coming.

Budgeting For Medical Costs With Reduced Income

Living on less money can be hard. It’s important to plan your spending. Health needs can be expensive, especially with less income. Here are ways to keep doctor costs in check:

- Know what your insurance covers and what you need to pay.

- Keep a list of all health costs to see where you can save money.

- Trace all the money you have to find out how much you can spend on healthcare.

Use tools like spreadsheets to track your budget. This keeps you on top of your healthcare spending.

Seeking Financial Assistance And Support Programs

When your income is small, getting help is key. Many programs can help pay medical bills. Here’s how you can find support:

- Ask the hospital about aid programs that can cut down your bills.

- Check if the state has health programs that can help you.

- Look for charities that give money to those with your sickness or injury.

Remember to talk to social workers; they guide you to the right aid programs. They can also help you with paperwork to get the financial help you need.

Credit: jpricemcnamara.com

Frequently Asked Questions

What Are The Cons Of Long-term Disability?

Long-term disability insurance may lead to reduced monthly benefits compared to your actual salary. Premium costs can be high, and policy limitations sometimes exclude certain conditions. There could also be lengthy waiting periods before benefits begin.

Can My Employer Cancel My Health Insurance While On Disability In Ca?

In California, employers cannot cancel health insurance while an employee is on disability. Coverage typically extends through the entire disability period, adhering to the company’s policy and state law.

Do You Lose Life Insurance When You Go On Long-term Disability?

Going on long-term disability does not automatically terminate your life insurance policy. Life insurance coverage typically remains active as long as premiums continue to be paid.

What Are Typically Long-term Disability Benefits?

Long-term disability benefits provide financial support to individuals unable to work for extended periods due to illness or injury, typically covering a portion of lost income.

Conclusion

Navigating health insurance during long-term disability can be complex. It’s vital to understand your policy or employer’s plan. Ensure you communicate with providers to maintain coverage. Expert advice or legal counsel might be helpful. Always stay informed to secure your health and financial well-being.