Coverage for Ozempic for weight loss under Blue Cross Blue Shield varies based on individual policy details and location. To determine eligibility, policyholders should consult their specific plan benefits.

Blue Cross Blue Shield, a widespread health insurance network in the United States, offers a range of policies that may include prescription drug coverage. The trending topic of Ozempic, known for its diabetes management properties, also sees off-label use for weight loss.

Patients interested in Ozempic for weight loss should review their Blue Cross Blue Shield plan, as coverage can differ significantly between individual plans and state regulations. It is essential for members to understand their policy’s formulary, required medical criteria, and any prior authorization processes. Engaging with a healthcare provider and contacting a Blue Cross Blue Shield representative provides clarity on whether this medication fits within the member’s healthcare strategy and financial considerations.

Introduction To Ozempic For Weight Loss

Ozempic, a medication primarily known for treating type 2 diabetes, is gaining traction in the weight loss community. Due to its effects on blood sugar levels and body weight, individuals are curious about its potential benefits for shedding extra pounds. Many wonder if insurance providers like Blue Cross Blue Shield cover this medication for weight loss purposes.

Origins Of Ozempic

Ozempic’s active ingredient, semaglutide, was initially developed for diabetes management. Created by pharmaceutical company Novo Nordisk, it works by mimicking a hormone that targets areas of the brain regulating appetite and calorie intake.

Popular Use In Weight Management

Though not its original use, Ozempic has shown promising results in weight management. Users report a decrease in hunger and an improved ability to control their eating habits, leading to noticeable weight loss. It’s a growing trend among those seeking medical assistance to combat obesity and maintain a healthy weight.

| Aspect | Detail |

|---|---|

| Generic Name | Semaglutide |

| Function | Appetite Regulation |

| Form | Injectable |

| Insurance Coverage | Varies by Provider |

Whether Blue Cross Blue Shield covers Ozempic for weight loss is a question with multiple considerations, including prescription specifics and individual insurance plans. As this medication’s popularity grows, so does the conversation around insurance support for weight management solutions.

Credit: www.singlecare.com

Understanding Blue Cross Blue Shield

Navigating healthcare can be complex. Blue Cross Blue Shield is among the largest health insurance providers. Many wonder if it covers specific treatments, like Ozempic for weight loss. Let’s delve into Blue Cross Blue Shield and its offerings.

History Of The Health Insurance Provider

Blue Cross Blue Shield started in the early 20th century. It has a legacy of trust and innovation in healthcare. The provider expanded over the years, now serving millions nationwide.

Coverage Spectrum And Plans

The insurer offers a wide range of plans. These cater to diverse needs and budgets. Coverage varies by plan and location. It’s important to check your policy for specifics. This includes availability of Ozempic coverage for weight loss.

- Individual and Family Plans

- Medicare and Medicaid Options

- Employer-Based Coverage

To confirm your plan covers Ozempic, reach out to Blue Cross Blue Shield directly. Their customer service can provide coverage details specific to your policy.

Navigating Insurance Coverage For Medications

Understanding insurance coverage for medications can often seem like navigating through a maze. One question that many ask is, “Does Blue Cross Blue Shield cover Ozempic for weight loss?” Unraveling the complexities of insurance policies, and knowing if your treatment is covered, can be a critical aspect of managing healthcare costs. Let’s delve into how to determine insurance eligibility specifically for medications like Ozempic.

Determining Insurance Eligibility

To find out if Blue Cross Blue Shield will cover Ozempic, it’s important to:

- Review Your Insurance Plan: Each plan has distinct coverage details.

- Contact Customer Service: A representative can confirm coverage for weight loss medications.

- Consult with Your Doctor: They can provide necessary documentation to aid your case.

Insurance providers may require a doctor’s prescription and proof of medical necessity for weight loss to approve coverage for Ozempic. Ensure these documents are ready when you inquire about your eligibility.

Pharmacy Benefits And Formularies

Understanding your plan’s formulary is key to knowing medication coverage. Blue Cross Blue Shield’s formulary is a list of approved medications that typically receive coverage. Here’s how to navigate it:

- Access the online member portal to view the formulary.

- Look for Ozempic or its generic equivalent in the list.

- Check the tier placement to understand co-pay amounts.

Medications placed in a higher tier could mean higher out-of-pocket costs. In some cases, your healthcare provider might help by providing a formulary exception request to secure coverage for Ozempic.

If Ozempic isn’t in the formulary, patients may need to consider alternative treatments that are covered, or explore the possibility of patient assistance programs for financial support.

Credit: jetmedicaltourism.com

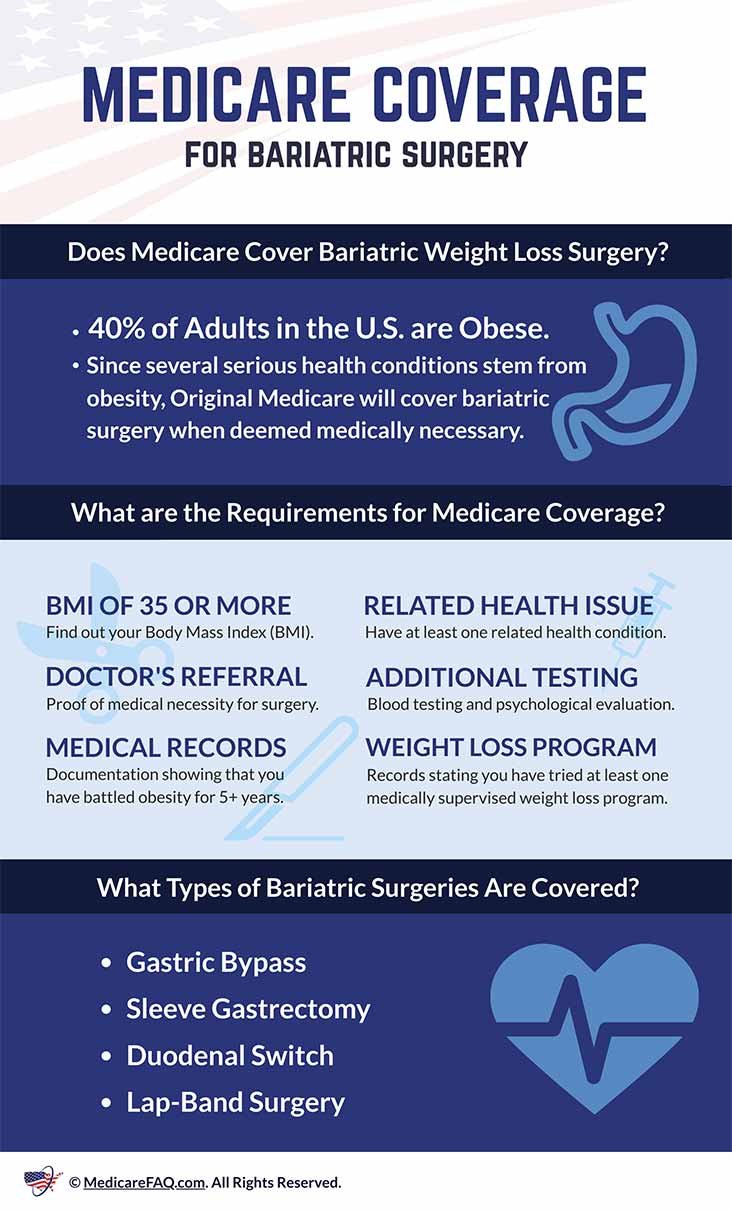

Criteria For Insurance Coverage Of Weight Loss Treatments

Understanding the criteria for insurance coverage is key when exploring weight loss treatments like Ozempic. Each insurance provider has specific guidelines. These cover medication like Ozempic under certain conditions. Here, we focus on Blue Cross Blue Shield’s approach to weight loss medication coverage.

Medical Necessity For Weight Loss Medication

Insurance companies often cover weight loss treatments when medically necessary. For Blue Cross Blue Shield, a doctor must confirm that weight loss medication is vital. This means the patient’s health would greatly benefit from the treatment. Ozempic, originally for type 2 diabetes, has shown effectiveness in weight management. But, it must be part of a comprehensive weight loss plan. The plan might include diet and exercise. It’s not just for cosmetic purposes.

Documentation And Approval Process

Approval processes can be complex. Blue Cross Blue Shield requires proper documentation before covering medications like Ozempic. Doctors must submit:

- A patient’s medical history

- Treatment plans

- Expected outcomes

Each document helps prove the need for weight loss medication. It must show a clear link to treating a health condition. The insurance then reviews the documentation. Patients often need prior authorization for coverage approval.

With these criteria, patients can navigate the insurance process. They will know when they can expect help with weight loss treatments. This is important for medications like Ozempic. Blue Cross Blue Shield provides clear guidelines for coverage that aligns with health needs.

Examining Blue Cross Blue Shield’s Stance On Ozempic

Seeking to understand your insurance coverage can feel like navigating a complex labyrinth. Blue Cross Blue Shield, a prominent player in health coverage, raises questions about its stance on Ozempic for weight loss. Let’s dive into the details of what they cover.

Official Policy Statements

Ozempic, known generically as semaglutide, is an FDA-approved medication. It’s primarily for type 2 diabetes management. Nonetheless, its weight loss benefits have caught the eye of many. But does Blue Cross Blue Shield support its use for shedding pounds?

The first step is scrutinizing Blue Cross Blue Shield’s official policy. Their formulary, a list of medicines they cover, reveals the whole story. Ozempic’s inclusion or exclusion speaks volumes about their current coverage position.

Policies can vary from state to state and plan to plan. Hence, contacting them directly or checking their online resources is wise. Always look for the latest updates, as insurance policies undergo frequent changes.

Case Studies And Precedents

Real-life cases shed light on insurance practices. Blue Cross Blue Shield members have shared their experiences with Ozempic coverage. These narratives hint at potential trends in insurance decision-making.

- Some members found full coverage when Ozempic was prescribed for diabetes.

- Others faced partial coverage or denial when sought purely for weight loss.

Analyzing these cases helps predict your own coverage chances. Remember, your medical profile and plan specifics are key determinants. It’s useful to document similar precedents when you approach Blue Cross Blue Shield for coverage queries.

Factors Influencing Coverage Decisions

Understanding whether Blue Cross Blue Shield covers Ozempic for weight loss involves diving into insurance details. Different things affect this decision. Let’s delve into these factors.

Plan Variation And Individual Circumstances

Not all insurance plans are the same. Your individual plan details play a huge role. Plans differ based on the state, employer, and the specific Blue Cross Blue Shield company. Each plan has its own list of covered drugs called a formulary.

- Check your plan’s formulary.

- Ask about tier placement for Ozempic.

- Find out about any required procedures before approval.

Different health conditions may influence coverage, too. The plan looks at your medical necessity. This includes your current health and weight. These aspects are critical.

Doctor Recommendations And Influence

A doctor’s support is pivotal. They need to confirm if Ozempic is right for you. They also have to convince the insurance about its necessity for your weight loss journey.

- Prescription based on clinical judgment.

- Submission of a prior authorization form.

- Evidence of medical necessity for your case.

Remember, a strong recommendation can sway the decision. Keep communication open with your healthcare provider. This ensures you get the best chance for coverage.

Alternatives To Ozempic Under Blue Cross Blue Shield

If you’re a Blue Cross Blue Shield member thinking about weight loss options, you might wonder about alternatives to Ozempic. While Ozempic may not always be covered, other solutions could fit your needs and your plan’s benefits. Let’s explore some of these possibilities.

Other Medications For Weight Loss

When Ozempic isn’t an option, other medications might help. Each drug works differently, so finding one that aligns with your health goals is vital. Always consult with your healthcare provider before starting any medication.

- Phentermine: An appetite suppressant that increases energy levels

- Orlistat: Reduces the amount of fat your body absorbs from food

- Contrave: Combines two medicines to control appetite and cravings

Lifestyle And Preventative Care Options

Losing weight isn’t solely about medications. Making healthy lifestyle changes can lead to sustainable weight loss. Blue Cross Blue Shield often supports programs that encourage these habits.

| Option | Description | Benefits |

|---|---|---|

| Nutrition Counseling | Professional guidance on eating habits | Better food choices |

| Fitness Programs | Exercise plans suited to your level | Increased physical activity |

| Stress Management | Techniques to handle stress healthily | Reduced emotional eating |

Weight loss journeys are unique, and your best path might be a blend of medication and lifestyle changes. Blue Cross Blue Shield plans vary, so check your specific coverage for details on these weight loss alternatives.

Steps To Take If Ozempic Is Not Covered

Knowing what to do if Ozempic is not covered by Blue Cross Blue Shield for weight loss is vital. Ozempic, a medication for type 2 diabetes, is sometimes used off-label for weight loss. However, insurance coverage for this purpose varies. If you discover that your plan does not cover Ozempic, don’t lose hope. You have options to explore, such as the appeals process and patient assistance programs.

Appeals Process For Denied Coverage

Begin by understanding the specific reasons for denial. Your policy includes guidelines about appeals. You may need to provide extra information, like a doctor’s letter stating why Ozempic is necessary for you. Here are steps to follow:

- Read denial letter carefully.

- Talk to your doctor for supporting documents.

- Submit the appeal within the deadline.

- Follow up regularly until a decision is reached.

Patience and persistence during the appeals process can make a difference. Insurance companies reconsider denied claims when provided with compelling evidence.

Exploring Patient Assistance Programs

If your appeal is unsuccessful, patient assistance programs may help. These programs, often offered by pharmaceutical companies, aim to provide medications to those who cannot afford them. Steps to explore these options include:

- Check the official Ozempic website for programs.

- Discuss with your healthcare provider about alternative assistance options.

- Look into national and community-based programs offering support.

- Review the eligibility criteria carefully to apply.

Many patients find financial relief through patient assistance programs. Necessary medications become accessible, even without direct insurance coverage.

Future Of Obesity Treatment And Insurance

The journey towards a healthier future often intersects with advancements in medical treatments and insurance coverage. Particularly for those wrestling with weight loss, the future holds promise with the evolution of obesity management. Innovations in medication, like Ozempic, paired with progressive insurance policies, could unlock new pathways to better health.

Evolving Insurance LandscapeEvolving Insurance Landscape

Insurance companies constantly refine their offerings to meet health demands. Blue Cross Blue Shield, a major insurer, exemplifies this by evaluating treatments like Ozempic for reimbursement. As weight loss becomes a significant health focus, insurers may embrace drugs proven to aid in obesity treatment.

- Health Plans: Adapting offerings to cover more obesity treatments.

- Policy Changes: Reflecting research on effective weight loss medications.

- Patient Support: Growing with educational resources and financial aid for obesity care.

Ozempic And Emerging Medications

Ozempic, known generically as Semaglutide, emerges as a powerful ally in obesity management. Designed originally for type 2 diabetes, its effectiveness in weight control is gaining attention. As such, insurance coverage for drugs like Ozempic could become widespread.

| Medication | Primary Use | Weight Loss Efficacy |

|---|---|---|

| Ozempic (Semaglutide) | Type 2 Diabetes | High |

| Other Medications | Varied | Under Research |

As insurers like Blue Cross Blue Shield assess drugs’ cost-effectiveness, their coverage could shift. Patients should monitor coverage updates and discuss treatment options with healthcare providers.

Conclusion: Making Informed Decisions

Knowing if Blue Cross Blue Shield covers Ozempic for weight loss matters to you. Your decision on health coverage is vital. This is where we wrap up what you learned.

Understanding Policy Limits

Each insurance policy has its own rules. Blue Cross Blue Shield policies vary. Some may cover Ozempic for weight loss, while others might not. Look at your plan details:

- Check the fine print to see what drugs your policy covers.

- Look for exclusions that could affect your coverage for Ozempic.

- Review the required criteria; some plans demand specific conditions for coverage.

Advocating For Personal Health Coverage

It’s your right to get the best health coverage. Fight for your health needs:

- Talk to your doctor about why Ozempic is necessary for you.

- Get documentation to show why you need this medication.

- Contact Blue Cross Blue Shield if you face coverage issues.

Your input can lead to changes in your policy. Don’t be afraid to ask questions. Health is a priority, and insurance should support your goals.

Credit: www.linkedin.com

Frequently Asked Questions

Does Insurance Cover Ozempic For Weight Loss?

Insurance coverage for Ozempic for weight loss varies by provider and policy. You should check with your insurance company for specific coverage details.

Does Blue Cross Blue Shield Cover The Weight Loss Shot?

Blue Cross Blue Shield may cover weight loss shots, but coverage varies by plan and location. Always check with your provider for specific benefits.

Why Is Ozempic Denied By Insurance?

Insurance may deny Ozempic due to lack of formulary coverage, insufficient prior authorization, or it deeming the medication not medically necessary for the patient’s condition. Cost considerations can also influence the denial decision by insurance providers.

Does Blue Cross Blue Shield California Cover Wegovy?

Blue Cross Blue Shield California’s coverage for Wegovy varies by plan. Members should check their individual policy details or contact customer service for specific coverage information.

Conclusion

Navigating insurance coverage for weight loss medications can be challenging. It’s essential to consult with Blue Cross Blue Shield for the most current information on Ozempic coverage. Your healthcare provider can also offer guidance and support in securing authorization for this treatment.

Remember, policies may vary, so personal verification is key.