A Medicare Supplement Basic Benefit covers gaps in Original Medicare coverage. It helps with co-payments, deductibles, and coinsurance.

Navigating the healthcare landscape can be daunting, especially as medical costs continue to rise. Medicare provides essential coverage for millions of seniors and individuals with disabilities, yet it doesn’t cover all medical expenses. This is where Medicare Supplement Insurance, also known as Medigap, comes in.

Medigap policies complement your Original Medicare benefits, easing the financial burden of healthcare expenses that Medicare doesn’t fully cover. By choosing a Medicare Supplement plan, beneficiaries ensure they have more predictable healthcare costs and can avoid unexpected medical bills that could disrupt their budget. Understanding the basics of Medicare Supplement coverage is crucial for anyone looking to secure their health and finances as they navigate the complexities of Medicare.

The Importance Of Medicare Supplement Basic Benefit

The Importance of Medicare Supplement Basic Benefit is crucial for seniors. It helps cover costs that Original Medicare does not. This includes copayments, coinsurance, and deductibles.

Bridging The Gaps In Medicare

Original Medicare leaves several healthcare costs uncovered. These gaps can be a financial burden. Medicare Supplement Basic Benefit steps in to fill these voids. It ensures that benefits like hospital stays and doctor visits are more affordable.

- Extended hospital care

- Skilled nursing facility coinsurance

- Part A and Part B deductibles

Financial Security In Health Emergencies

Unexpected health issues can lead to large medical bills. Medicare Supplement Basic Benefit provides a safety net. This benefit reduces out-of-pocket costs during health emergencies.

| Benefit | Coverage |

|---|---|

| Hospitalization | Part A coinsurance plus coverage for 365 additional days after Medicare benefits are used up |

| Medical Costs | Part B coinsurance (generally 20% of the Medicare-approved amount) |

| Blood | First three pints of blood each year |

With these benefits, seniors can manage health costs better. This peace of mind is priceless during unexpected health issues.

Credit: www.medicarefaq.com

What Is Medicare Supplement Basic Benefit?

Navigating the world of Medicare can be complex. One term that often comes up is Medicare Supplement Basic Benefit. This refers to the foundational coverage provided by Medicare Supplement Insurance, also known as Medigap. These plans are designed to cover costs not paid by Original Medicare.

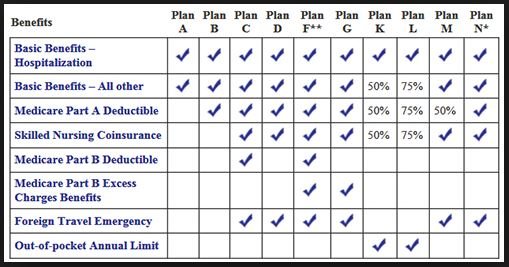

Core Features Of Medigap Plans

Medigap plans have several core features that set them apart from other health insurance plans. They fill the gaps in Original Medicare coverage.

- Co-insurance and co-payments of Part A and Part B

- Deductibles of Medicare Part A and Part B

- Foreign travel emergency coverage (up to plan limits)

- First three pints of blood for medical procedures

Comparing Original Medicare And Medigap

Original Medicare includes Part A and Part B. It covers hospitals and doctors but not all costs. Medigap plans help cover what Original Medicare does not.

| Original Medicare | Medigap |

|---|---|

| Hospital stays | Part A deductible and co-insurance |

| Doctor visits | Part B co-insurance or co-payments |

| No foreign travel coverage | Covers 80% of foreign travel emergency |

| Pay for first three pints of blood | Covered by Medigap |

Medigap plans make managing healthcare costs easier for beneficiaries. They offer peace of mind by reducing out-of-pocket expenses.

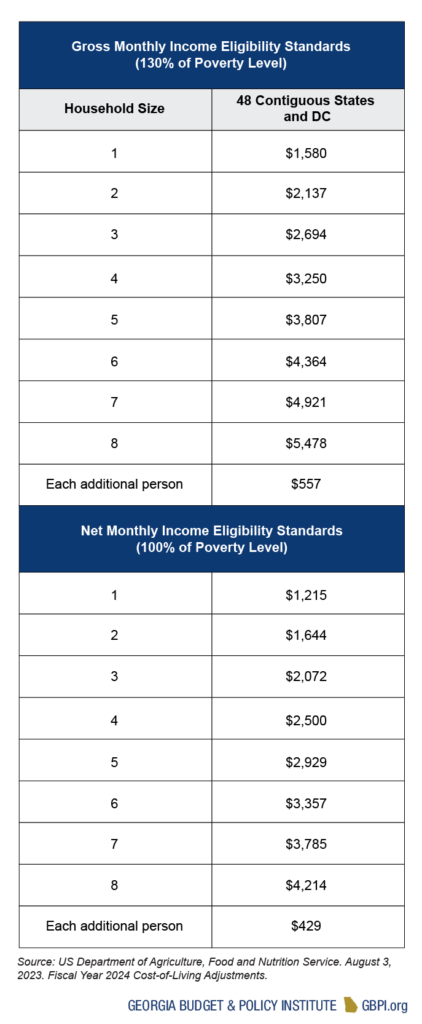

Eligibility Criteria For Medicare Supplement

Understanding the Eligibility Criteria for Medicare Supplement, or Medigap, is crucial for those seeking additional health coverage. Medigap fills the gaps in Original Medicare. It helps with costs like deductibles and co-payments. But who qualifies for this extra layer of financial safety? Let’s dive into the specifics.

Qualifying For Medigap Coverage

To qualify for Medigap, one must first enroll in Medicare Part A and B. Age is also a factor. You must be 65 or older. Certain younger people with disabilities may also qualify. It’s important to know that having Original Medicare is a must. Without it, one cannot get a Medigap plan.

Medigap policies are individual, meaning spouses need separate plans. It’s not a family plan. This ensures each person gets the coverage they need.

Enrollment Periods And Deadlines

The best time to buy a Medigap policy is during your Medigap Open Enrollment Period. This period lasts for six months. It starts the first month you’re 65 and enrolled in Medicare Part B. During this time, you have a guaranteed right to buy any Medigap policy. Companies cannot deny you coverage or charge more due to health issues.

Missing this enrollment period may result in higher costs. You might also be denied coverage. To avoid these risks, mark your calendar. Enroll as soon as you’re eligible.

Remember, outside of this period, protections are limited. Insurance companies may require medical underwriting. This could affect your premiums and your ability to get a policy.

Keep track of enrollment windows and deadlines. Doing so ensures you secure the benefits you need when you need them.

Credit: www.in.gov

Analyzing The Cost Of Medigap Plans

Understanding the costs involved with Medigap plans is essential for anyone on Medicare. These supplement plans can help cover out-of-pocket expenses not paid by Medicare. Let’s dive into the details of premiums, deductibles, and co-pays, and explore how to find affordable supplement plans.

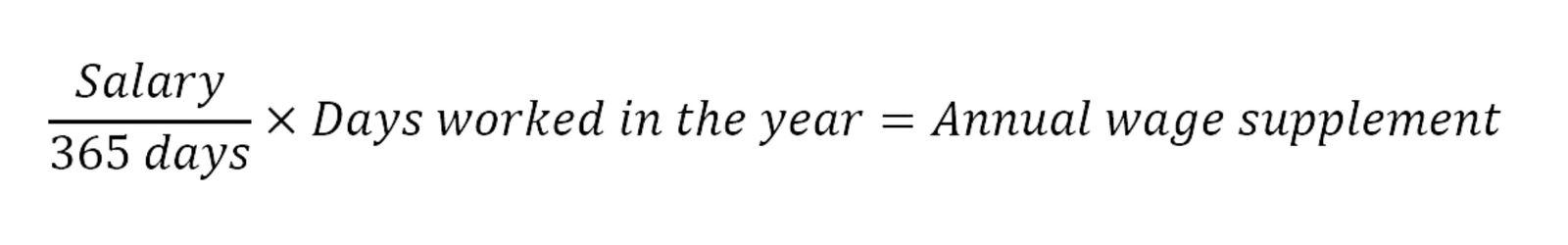

Premiums

Medigap plan premiums vary by provider and location. They are the monthly fees you pay to keep your policy active. Factors like age, tobacco use, and when you enroll can affect your premium cost. Some plans offer community-rated pricing where everyone pays the same, regardless of age. Others use age-rated pricing which can increase as you get older.

Deductibles

Deductibles are what you pay before your Medigap plan begins to pay. Some Medigap plans have annual deductibles. These deductibles can impact your overall healthcare costs. Plans F and G have high-deductible options, potentially lowering your premium but requiring you to pay more before coverage kicks in.

Co-pays

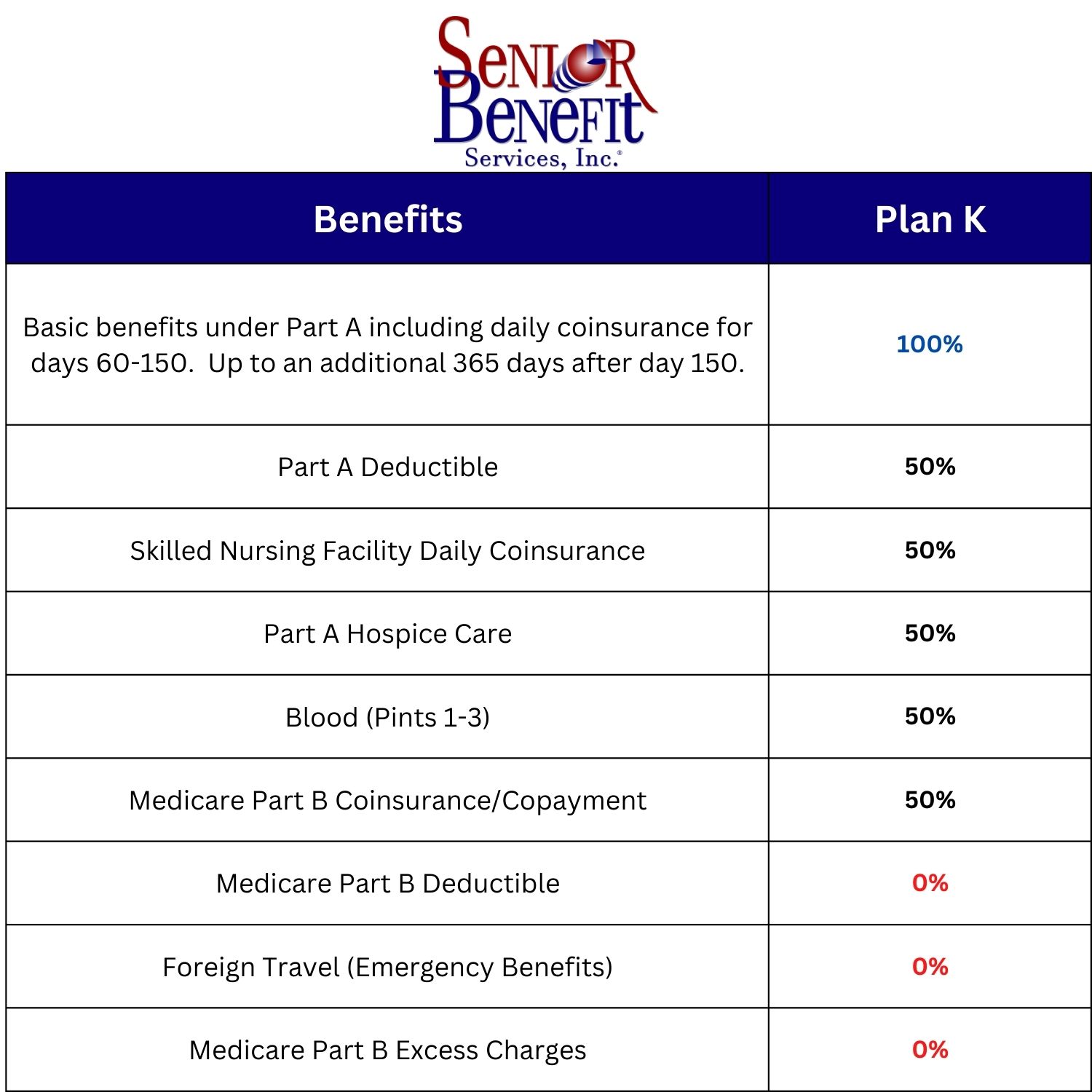

Co-pays are the fixed amounts for healthcare services. With Medigap, some plans cover these costs completely, while others require a co-pay. Plan K and L share costs with you until you reach the out-of-pocket limit. Knowing the co-pay structure is key to understanding your potential expenses.

Finding Affordable Supplement Plans

To find the most affordable Medigap plan, compare different plans and providers. Look at the benefits versus the costs. Some plans may offer extra perks like foreign travel emergency coverage. Use Medicare’s Plan Finder tool to compare prices and benefits. Remember to review annually, as your needs and plans may change.

Common Myths About Medicare Supplement Plans

Medicare Supplement Plans, also known as Medigap, are riddled with misconceptions. It’s time to separate fact from fiction and give you the clarity you need when considering these plans for your healthcare needs.

Debunking Misconceptions

Many believe that Medigap plans are too complex. Let’s simplify the facts.

- Medigap plans do not replace Original Medicare.

- These plans cover gaps in Medicare Parts A and B.

- You can visit any doctor that accepts Medicare.

- Medigap plans are standardized, making them easy to compare.

- Enrollment is not restricted to the annual fall window.

The Truth Behind Coverage And Costs

Costs and benefits are a major focus for anyone considering a Medigap plan. Let’s look at the reality.

| Aspect | Fact |

|---|---|

| Monthly Premiums | Vary by plan, not by use. |

| Coverage | Same for all plans of the same letter. |

| Out-of-Pocket Costs | Reduced significantly with Medigap. |

| Prescription Drugs | Not covered; Part D is separate. |

By understanding the truth about coverage and costs, you can make informed decisions about your healthcare. Choose wisely and get the benefits you deserve.

Choosing The Right Medicare Supplement Plan

Understanding Medicare Supplement plans is crucial for ensuring comprehensive healthcare coverage. This guide helps navigate the process of choosing the right plan.

Assessing Your Healthcare Needs

Start by evaluating personal healthcare requirements. Consider current health, medical history, and potential future needs. This step is pivotal.

- Doctor visits: Frequency and specialty care

- Prescriptions: Regular medications

- Travel: Coverage outside the U.S. needed?

Comparing Different Medigap Policies

Medigap policies fill gaps in Original Medicare. Each plan is different. Comparison is key.

| Plan | Benefits | Costs |

|---|---|---|

| Plan A | Basic benefits | Lower |

| Plan G | Extensive coverage | Higher |

| Plan N | Balance of cost and coverage | Medium |

Research each plan’s specifics. Factor in premium costs, deductibles, and co-payments. Choose the plan that aligns best with health needs and budget.

The Role Of Medicare Supplement In Long-term Care

Understanding the role of Medicare Supplement in long-term care is key for anyone planning their healthcare future. These supplements can fill gaps in traditional Medicare coverage, including aspects of long-term care.

Coverage For Extended Healthcare Services

Medicare Supplement plans, often known as Medigap, offer added peace of mind. These plans cover costs that Original Medicare does not.

- Copayments for extended hospital stays

- Coinsurance for skilled nursing facilities

- Deductibles that Medicare beneficiaries would otherwise pay out-of-pocket

While Medigap plans do not cover long-term care such as nursing home stays or home health aide services, they ensure that the costs associated with the recovery period after hospitalization or a skilled nursing facility are more manageable.

Planning For Future Healthcare Needs

Long-term care involves a range of services to meet personal care needs over an extended period. Planning ahead with a Medicare Supplement plan is a proactive step.

| Medicare Part | Covers | Medigap Role |

|---|---|---|

| A (Hospital Insurance) | Hospital care, nursing facility care | Covers some of the costs not paid by Part A |

| B (Medical Insurance) | Doctor’s services, outpatient care | Covers some of the costs not paid by Part B |

Choosing the right Medigap policy requires understanding the potential for long-term care needs and aligning coverage accordingly. It’s about securing your health and financial well-being as you age.

Navigating Policy Changes And Updates

Medicare Supplement plans evolve with changing healthcare laws. It’s vital for beneficiaries to stay current. Policy updates can impact coverage and out-of-pocket costs. Understanding these changes ensures the right coverage and compliance with new rules.

Staying Informed On Legislation

Legislation can alter Medicare Supplement benefits. Beneficiaries must stay informed. Sources include:

- Official Medicare website

- Insurance providers

- Healthcare advisors

- Government health departments

Regular checks on these sources keep users updated. This helps in making informed decisions about healthcare coverage.

Adjusting Coverage To Meet New Regulations

New regulations may necessitate coverage adjustments. Users should:

- Review policy changes annually

- Assess personal healthcare needs

- Consult with insurance experts

Timely adjustments to coverage can save money. They also ensure continued compliance with Medicare rules.

Real-life Stories: The Impact Of Medigap Coverage

Navigating the healthcare landscape can be complex. Medicare Supplement Insurance, also known as Medigap, steps in to fill the gaps. This coverage helps manage out-of-pocket costs not covered by original Medicare. Through real-life stories, the value of Medigap becomes clear. These tales highlight the financial and emotional relief provided by additional coverage.

Testimonials From Medigap Policyholders

- John’s Journey: Faced with unexpected surgery, John’s Medigap plan covered his deductible. He paid little out-of-pocket.

- Linda’s Lesson: After a specialist visit, Linda’s Medigap policy took care of the 20% coinsurance. She felt secure and cared for.

- Tom’s Tale: Tom encountered high prescription costs. His Medigap plan made his medication affordable.

How Medigap Has Made A Difference

| Policyholder | Challenge | Medigap Solution |

|---|---|---|

| Emma | High hospital bills | Medigap covered most costs |

| George | Regular doctor visits | Co-pays handled by Medigap |

| Rachel | Out-of-country emergency | Medigap provided travel coverage |

Each story shows Medigap’s role in reducing stress and protecting savings. These accounts demonstrate the tangible benefits of having a Medigap policy in place.

Credit: seniorbenefitclient.com

Frequently Asked Questions

What Are Basic Medicare Benefits?

Basic Medicare benefits include hospital insurance (Part A), medical insurance (Part B), and prescription drug coverage (Part D). These cover hospital stays, doctor visits, and medications.

What Is A Medicare Supplement Policy Quizlet?

A Medicare Supplement policy, often called Medigap, helps cover costs not included in original Medicare. These policies are sold by private companies and can reduce out-of-pocket expenses.

What Is A Medicare Supplement Policy?

A Medicare Supplement policy, also known as Medigap, helps cover healthcare costs not included in Original Medicare, such as copayments, coinsurance, and deductibles.

Which Of The Following Is A Core Benefit In A Medicare Supplement Policy?

A core benefit of a Medicare Supplement policy is coverage for copayments, coinsurance, and deductibles not covered by Medicare Part A and B.

Conclusion

Navigating Medicare can be complex, yet understanding the basic benefits of Medicare Supplement plans is crucial. These plans cushion against unforeseen medical expenses, ensuring peace of mind. Remember, choosing the right plan hinges on individual health needs and financial circumstances.

Invest time in research to secure your healthcare future effectively. Explore your options and stay informed for a sound decision.