Supplemental pay refers to earnings beyond an employee’s regular wages. It often includes bonuses, overtime, and commission.

Supplemental pay serves as an extra financial incentive for employees, complementing their base salary. It’s a key factor in total compensation packages and can significantly impact an individual’s earnings. From rewarding exceptional performance to compensating for additional hours worked, supplemental pay can take various forms.

It boosts employee morale and can be a strategic tool for employers to attract and retain top talent. Understanding the components of supplemental pay is vital for both employers crafting competitive compensation plans and employees negotiating their salaries. This form of pay also affects tax calculations, making it an important aspect of financial planning and management.

Introduction To Supplemental Pay

Welcome to our detailed exploration of Supplemental Pay. This key aspect of compensation packages often influences job satisfaction and employee retention.

Defining Extra Earnings

Supplemental pay includes earnings beyond the regular salary. This may involve:

- Overtime payments

- Bonuses

- Commission

- Holiday pay

These payments reward extra efforts or compensate for special work conditions.

Importance In Employee Compensation

Supplemental pay plays a crucial role in a compensation strategy. It helps:

- Attract skilled professionals

- Boost employee morale

- Encourage productivity

By offering these extra earnings, companies can maintain a motivated workforce.

Credit: www.zippia.com

Types Of Supplemental Pay

Workers often receive more than just their basic salary. This extra income is known as supplemental pay. It comes in various forms, each with its own rules and benefits. Let’s dive into the different types of supplemental pay that employees may encounter.

Overtime Pay

Overtime pay is extra money earned for hours worked beyond the standard workweek. In the United States, the Fair Labor Standards Act (FLSA) generally requires that employees get paid one and a half times their regular rate for any hours worked over 40 in a workweek.

Bonus Structures

Bonuses are additional pay given for performance, milestones, or as a year-end reward. Employers may offer bonuses to motivate employees or to reward them for exceeding goals. Bonuses can vary widely in amount and frequency.

Commissions

Commissions are typically paid to sales employees as a percentage of the sales they generate. This type of pay encourages sales staff to increase their sales volume, directly impacting their earnings.

Shift Differentials

Employees working late nights, early mornings, or weekends may receive shift differentials. This is extra pay offered as an incentive for working less desirable hours. It compensates for the inconvenience of such schedules.

Understanding Overtime Pay

When employees work beyond their regular hours, they enter the realm of overtime pay. This extra compensation is a vital part of supplemental pay. It rewards hard work and ensures fair wages. Understanding overtime pay is key for both employers and employees.

Legal Requirements

Overtime laws vary by country and region. In the United States, the Fair Labor Standards Act (FLSA) sets the stage. It requires employers to pay employees one and a half times their regular rate for hours worked over 40 in a workweek. Some states have additional rules on overtime.

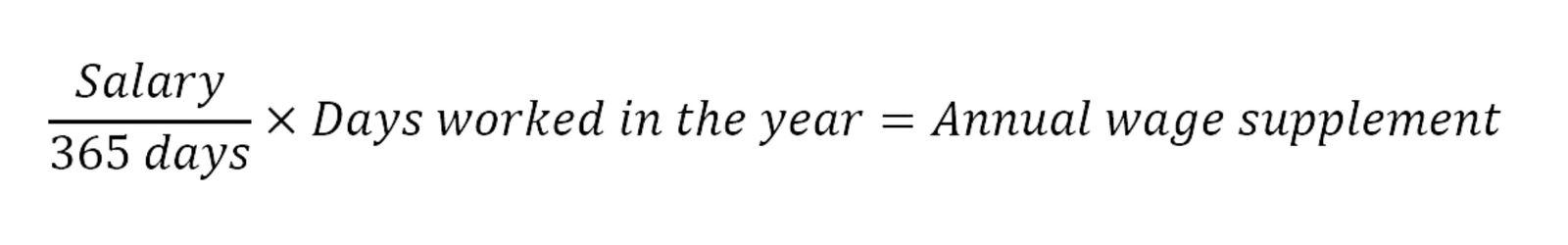

Calculating Overtime

Calculating overtime pay involves some simple math. Employers must first determine the employee’s regular pay rate. Then, they multiply this rate by 1.5 for each hour of overtime. Some employees receive a fixed salary. For them, employers divide the weekly salary by the number of regular work hours to find the regular rate.

Let’s break down the steps:

- Determine the regular pay rate.

- Count all hours worked over the standard 40-hour workweek.

- Multiply the regular rate by 1.5 for each overtime hour.

For example, if an employee earns $20 per hour and works 45 hours in a week:

- The first 40 hours are paid at the regular rate of $20/hour.

- The next 5 hours are paid at the overtime rate of $30/hour (1.5 x $20).

| Hours Worked | Regular Rate | Overtime Rate | Total Pay |

|---|---|---|---|

| 40 | $20 | $0 | $800 |

| 5 | $20 | $30 | $150 |

| Total | $950 |

Employers must keep accurate records of hours worked and pay rates. This ensures correct overtime pay and compliance with the law.

Bonuses As Supplemental Income

Bonuses often come as a welcome addition to regular wages. They boost overall earnings. Companies provide different types of bonuses. These are forms of supplemental pay. Let’s explore some common bonuses.

Year-end Bonuses

Many look forward to the end of the year. It’s not just for the holidays. Year-end bonuses bring extra cheer. Employers give these to appreciate hard work throughout the year. They are a token of gratitude. Employees receive a lump sum. This bonus might reflect the company’s performance too.

Performance-based Incentives

Do you excel at your job? You might earn a performance-based bonus. These incentives reward excellent work. They encourage employees to exceed targets. The better the performance, the higher the bonus. This system promotes a high-performance culture.

Signing Bonuses

Signing bonuses attract new talent. Companies offer a one-time payment. This happens when you join the team. It’s an upfront show of commitment. This bonus can sway a candidate to pick one job offer over another. It’s a win-win. The company secures top talent. Employees get immediate extra cash.

Commissions: Earnings On Sales

In the realm of supplemental pay, commissions stand out as a dynamic way to reward sales performance. These earnings directly link to an individual’s ability to sell. Sales professionals often see commissions as a key part of their total income. Let’s delve into the various commission structures and their impact on total earnings.

Commission Structures

Different industries follow distinct commission models. Below are common structures used to calculate commission pay:

- Percentage of Sales: Employees earn a set rate for each sale.

- Tiered Commission: Rates increase after reaching sales targets.

- Draw Against Commission: A guaranteed pay that must be ‘earned back’ through sales.

- Residual Commission: Continual earnings from repeat customer sales.

Each structure motivates sales professionals in unique ways. The best structure depends on the business goals and sales environment.

Impact On Total Earnings

The impact of commissions on total earnings can be substantial. Commission pay may fluctuate based on:

- Sales volume

- Individual or team performance

- Market conditions

High-performing salespeople can significantly boost their income through commissions. On the flip side, during slower sales periods, earnings may decrease. Understanding the commission structure is crucial for employees to predict their income.

Commissions incentivize sales teams to perform at their best. This performance-based pay can lead to higher earnings and business growth. Hence, it is a win-win for both the employee and the employer.

Credit: factorialhr.com

Shift Differentials And Extra Pay

Understanding how Shift Differentials and Extra Pay work is crucial for both employers and employees. This form of supplemental pay rewards staff for working hours outside the typical 9-to-5 schedule. Let’s dive into what shift differentials mean and the industries where they are common.

Defining Shift Differentials

Shift differentials are extra pay rates offered to employees. Workers earn this for covering less desirable hours. Typically, these hours fall at night, over weekends, or during holidays. The aim is to compensate for the inconvenience or additional challenges of working these periods.

Industries With Shift Premiums

Several sectors recognize the need for shift differentials. They offer extra pay to ensure coverage at all times. Here are some:

- Healthcare: Hospitals operate 24/7, requiring round-the-clock staffing.

- Manufacturing: Factories often run multiple shifts to keep production lines moving.

- Security: Overnight guards ensure property safety when others are asleep.

- Transportation: Drivers and support staff keep goods moving at all hours.

- Customer Service: Call centers need staff ready to assist, regardless of the time zone.

Supplemental Pay For Special Circumstances

Workers often receive supplemental pay for unique job situations. This extra compensation rewards their extra efforts or compensates for unusual work conditions.

Hazard Pay

Hazard pay is extra money for risky jobs. It’s for workers facing potential harm. Examples include firefighters and construction workers on high-rise buildings.

- Compensation for risk exposure

- Varies by industry and job role

On-call Pay

On-call pay supports employees ready to work at short notice. It’s common in healthcare and IT. These workers must stay available outside regular hours.

- Extra pay for being available

- Often includes specific rules for response times

Severance Pay

Severance pay is given when jobs end unexpectedly. It helps workers transition. The amount can depend on job tenure and the reason for job loss.

- Financial support after job loss

- Can include extended benefits like health insurance

Credit: www.leapsome.com

Tax Implications Of Supplemental Pay

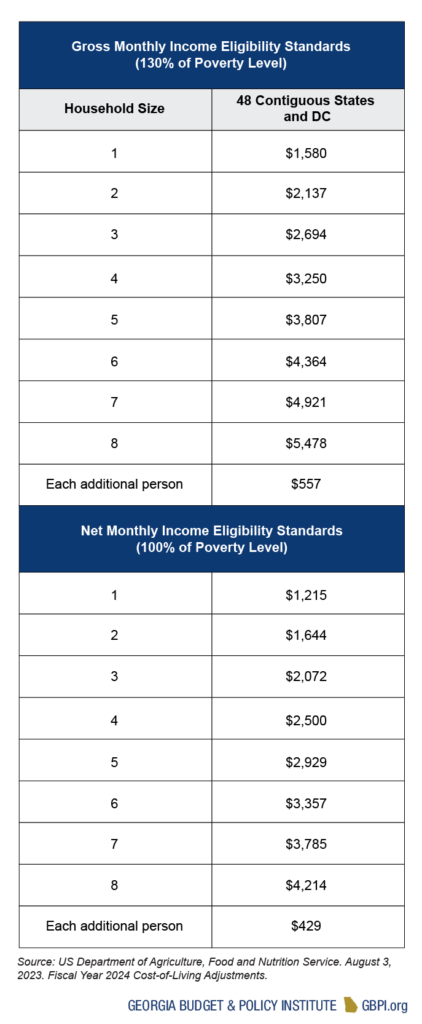

Understanding the tax implications of supplemental pay is crucial for both employers and employees. This type of pay includes overtime, bonuses, commissions, and other additional compensation. It is subject to specific tax requirements. It is important to grasp how the IRS treats these earnings.

Withholding On Supplemental Wages

Supplemental wages have unique withholding rules. The IRS allows two methods: the percentage method and the aggregate method.

- Percentage method: This applies a flat tax rate of 22% to supplemental wages up to $1 million.

- Aggregate method: This combines supplemental wages with regular wages, taxing the total as one.

Employers choose the method based on what works best for their payroll system. Employees should check their pay stubs to ensure correct withholdings.

Reporting Extra Earnings

Reporting supplemental pay correctly on tax forms is essential. Employers must include these earnings on an employee’s Form W-2.

| Type of Supplemental Pay | Reporting Requirement |

|---|---|

| Bonuses and Commissions | Reported in boxes 1, 3, and 5 |

| Overtime Pay | Reported as part of gross wages |

| Tips | Reported in box 7 |

Employees should verify all supplemental wages on their W-2 forms. Report any discrepancies to the employer as soon as possible.

Supplemental Pay And Employee Morale

Supplemental pay is a term that describes the extra money employees receive. This is over their regular salary. Examples include bonuses, overtime, and commission. Supplemental pay can boost how employees feel at work. Happy workers often do better at their jobs.

Incentivizing Performance

Companies use supplemental pay to encourage employees to exceed goals. Performance bonuses reward hard work. This makes staff want to achieve more. When employees see extra pay for extra effort, they feel valued.

Attracting And Retaining Talent

Good workers look for jobs that reward their skills. Supplemental pay helps. It brings in top talent. It also keeps them from leaving. A strong pay package stands out. It shows a company cares for its team.

Legal Considerations

Understanding the legal aspects of supplemental pay is crucial for businesses to ensure compliance and avoid penalties. This section highlights key legal considerations.

Federal And State Regulations

Different rules apply based on location and job type. Both federal and state laws govern supplemental pay. Employers must stay informed about these regulations to manage payroll effectively.

- Federal laws set minimum standards.

- State laws can vary greatly, sometimes offering more protections.

For example, overtime pay requirements differ across states. Employers should consult local laws to ensure they meet all legal standards.

Compliance With Labor Laws

Adhering to labor laws is essential for any business. It helps avoid legal issues and ensures fair treatment of employees.

| Law Type | Description | Impact |

|---|---|---|

| Minimum Wage | Ensures employees receive a minimum hourly wage. | Affects base and supplemental pay calculations. |

| Overtime | Extra pay for hours worked beyond the standard. | Requires careful tracking of hours. |

Businesses must regularly review their pay practices. This ensures they align with current labor laws. Regular audits can help identify and rectify any discrepancies quickly.

Challenges With Supplemental Pay

Challenges with Supplemental Pay often stem from its management and fairness. Companies face several hurdles when offering these extra earnings.

Administrative Complexity

Managing supplemental pay proves tricky. Each type of pay has different rules. These include overtime, bonuses, and commissions. Employers must track all these accurately. This requires robust systems and diligent administrative support. Without these, errors occur. Errors in payroll can lead to employee dissatisfaction and legal issues.

Equity And Fairness Issues

Ensuring fairness in supplemental pay is a major challenge. Employees doing similar work expect similar pay. Yet, supplemental pay can create gaps. For instance, bonuses might depend on departmental performance rather than individual effort. This can lead workers to feel undervalued. It raises concerns about equity within the workplace.

- Transparency in how decisions about supplemental pay are made is crucial.

- Regular reviews of pay practices help maintain fairness.

Future Of Supplemental Pay

The landscape of employee compensation is ever-evolving. With changing dynamics in the job market, supplemental pay has become a critical element. It is not just about the base salary anymore. Employers and employees alike look to supplemental pay to provide flexibility and additional benefits. The future of supplemental pay shines bright as trends and workforce needs change.

Trends In Compensation

As we move forward, compensation trends are shifting. Companies now offer more than just a paycheck. They include bonuses, equity, and other incentives. These extras keep staff happy and motivated. Technology also plays a big role. It allows for more personalized and immediate rewards. This is key in retaining top talent.

- Performance Bonuses: Rewarding hard work boosts morale.

- Profit Sharing: This ties success to the company’s performance.

- Stock Options: Employees invest in their workplace’s future.

Adapting To A Changing Workforce

The workforce is changing. People seek jobs that offer more than just money. They want work-life balance, growth, and purpose. Employers are responding. They are creating supplemental pay packages that cater to these desires. Flexible hours and wellness programs are now common. These benefits appeal to younger generations. They also attract skilled professionals.

| Benefit | Impact |

|---|---|

| Remote Work Options | Attracts talent from different locations |

| Learning Opportunities | Encourages personal and professional growth |

| Health Benefits | Improves overall employee well-being |

Adaptation is key. Companies that evolve with their workforce will thrive. Those that do not will struggle to keep up. The future of supplemental pay is bright. It promises a more holistic approach to compensation. This approach benefits everyone involved.

Frequently Asked Questions

What Is An Example Of Supplemental Pay?

Supplemental pay includes bonuses, overtime pay, commissions, and hazard pay.

What Is The Meaning Of Supplemental Salary?

A supplemental salary is additional pay given beyond a base salary, often to reward performance or cover extra duties.

What Does Supplement To Pay Mean?

A supplement to pay is an additional amount added to the usual cost or charge, often due to special circumstances or requirements.

What Is The Meaning Of Supplemental Income?

Supplemental income refers to extra money earned besides one’s primary salary, often from part-time work, freelancing, or investments.

Conclusion

Understanding supplemental pay is crucial for both employees and employers navigating compensation structures. It enhances base salaries, reflecting the value of extra work or unique circumstances. By recognizing its forms and implications, you can make informed financial decisions. Keep this guide handy to ensure you’re fully leveraging your earning potential.