To get insurance to cover Ozempic for weight loss, consult your healthcare provider for a prescription and check your policy’s specifics for obesity treatment coverage. Ensure your diagnosis aligns with insurance requirements to increase the likelihood of coverage.

Navigating the complexities of insurance coverage for weight loss medications can seem daunting. Ozempic, also known by its generic name semaglutide, is originally approved for managing type 2 diabetes but has shown effectiveness in weight loss. Securing insurance approval requires meeting certain medical criteria and demonstrating a clinical need for the drug based on your health status.

A clear understanding of your insurance plan’s guidelines for weight management medications is crucial. Collaborate with your healthcare professional to document your weight loss journey and medical necessity. They can provide the necessary support through thorough documentation and a strong justification for why Ozempic is the right choice for your weight loss treatment plan. Emphasizing the potential health benefits and cost-effectiveness of preventing obesity-related complications might persuade insurance providers to approve the medication.

The Rise Of Ozempic For Weight Loss

Ozempic has taken the spotlight in the world of weight loss, offering a new hope for many struggling with obesity. Recognized for its hitherto use in managing diabetes, this medication has forged a new path into weight management. With rising interest, it’s essential to understand how Ozempic works and its effectiveness.

What Is Ozempic?

Originally developed for type 2 diabetes, Ozempic, or semaglutide, is a prescription medication. It assists the body in regulating insulin levels but has shown remarkable effects on weight loss. Administered as a weekly injection, it is growing in popularity for those seeking assistance beyond traditional methods.

Effectiveness In Weight Management

Clinical studies have shown Ozempic to be an effective weight loss tool. It works by mimicking a hormone that targets areas of the brain involved in appetite regulation. Users report feeling fuller for longer periods, leading to reduced calorie intake and weight loss.

- Studies show significant weight loss in most users

- Greater results when combined with diet and exercise

- Assists with appetite control and reduced calorie intake

Credit: www.nbcnews.com

Understanding Insurance Coverage

Insurance can be tricky, especially when it comes to covering medications like Ozempic for weight loss. Your health plan may have specific steps to follow. Learn about the basics and what criteria your medication needs to meet for coverage.

Basics Of Health Insurance

Health insurance policies differ, but they typically cover a range of medical expenses. These include doctor’s visits, hospital stays, and medications. Prescription drugs often have a separate section in your policy. It explains what is covered and under what conditions.

- Monthly premiums – This is what you pay for your insurance plan.

- Deductibles – Money you pay before your insurance starts to cover costs.

- Copayments and coinsurance – Your share of the costs for a covered healthcare service.

- Formulary – A list of covered drugs and possible generic alternatives.

Coverage Criteria For Medications

To have a medication like Ozempic covered, it must meet specific criteria. Your policy’s formulary holds the key to what is considered necessary. This is often based on FDA approval and clinical guidelines for treatment.

| Criteria | Description |

|---|---|

| FDA Approval | The drug must be approved for your condition. |

| Clinical Guidelines | Treatment must align with accepted medical practice. |

| Prior Authorization | Your doctor may need to prove the drug is necessary. |

| Step Therapy | You might need to try less expensive drugs first. |

Contact your insurance provider and ask about Ozempic coverage. Each company has its own process. Even with approval, you may face out-of-pocket costs. Know your plan details to navigate the insurance world with ease.

Ozempic’s Insurance Landscape

Navigating the insurance landscape for Ozempic coverage can be a maze. As a prescription medication approved for type 2 diabetes and now gaining popularity for weight loss, understanding insurance intricacies is crucial. The right strategy can unlock coverage benefits and reduce out-of-pocket costs.

Current Insurance Challenges

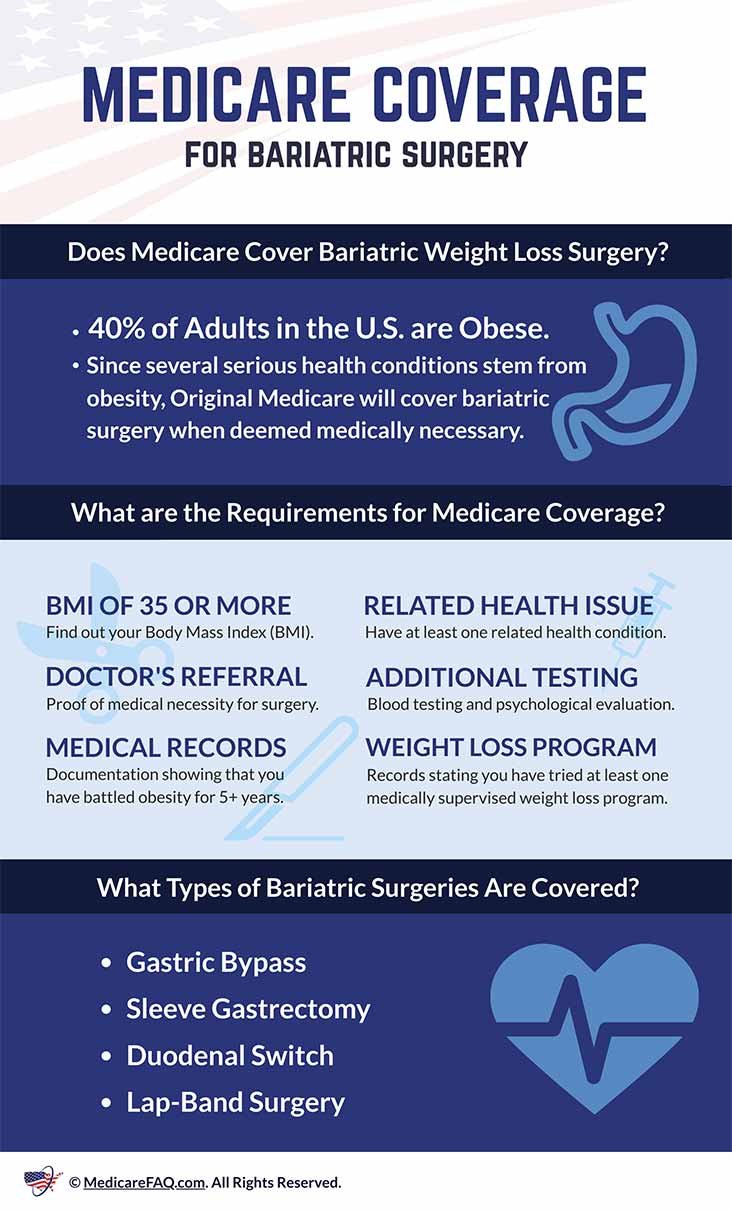

Finding coverage for Ozempic poses hurdles. Insurers scrutinize weight loss medications differently than other drugs. The FDA approves Ozempic for diabetes management, but using it for weight loss is off-label. This often leads insurers to deny coverage.

Patients must demonstrate necessity through medical records and continuous doctor’s involvement. Many policies require evidence of previous weight management attempts before considering coverage for weight loss prescriptions.

Insurers also impose strict qualification criteria such as BMI limitations or associated weight-related conditions.

Differences In Policy Coverage

Insurance policies vary widely. Some offer partial Ozempic coverage, while others count it as an out-of-network medication. Co-pays can differ significantly from plan to plan.

| Insurance Type | Coverage Level | Typical Co-pay |

|---|---|---|

| Private | Moderate to High | $25 – $100 |

| Medicare/Medicaid | Varies | $10 – $50 |

| Out-of-Network | None | Full cost |

Reading through policy documents and talking to insurance representatives can provide clarity. Some plans might need a specific diagnosis code for submission. An experienced healthcare provider often knows the optimal way to file claims.

In some cases, patients might be eligible for manufacturer discounts or rebate programs. Researching these options can further offset costs.

Preparing Your Case

When embarking on the journey to secure insurance coverage for Ozempic for weight loss, preparation is key. It’s similar to building a strong foundation for a house. Without solid ground, the house can crumble. The same principle applies to building a strong case for insurance approval. This vital step, often overlooked, can be the difference between an approval and a denial from your insurance company. Let’s delve into how you can prepare effectively.

Gathering Medical Documentation

Start by compiling all your medical records. This includes your health history and past treatments for weight-related issues. Organize them in a way that clearly shows the need for Ozempic as an essential part of your weight loss strategy. These documents can include:

- Medical tests: Blood work, glucose tests, or other related screenings.

- Doctor’s notes: Proving previous weight loss efforts under medical supervision.

- Treatment plans: Any relevant health programs you may have followed.

Insurance companies look for well-documented cases before approving medication like Ozempic.

Support From Healthcare Providers

Getting a thumbs up from your healthcare provider can make all the difference. Your doctor’s support is not just helpful; it’s critical. A letter from your doctor that explains the necessity of Ozempic for your weight loss can elevate your case. This letter should highlight:

- Your medical necessity: Why you need Ozempic specifically.

- Risks of not taking the medication: Potential health issues without Ozempic.

- Expected benefits: How Ozempic can improve your overall health.

Insurance providers often defer to the opinion of healthcare professionals, so this support is crucial.

Strategies To Convince Your Insurer

Getting insurance coverage for Ozempic, especially for weight loss, involves convincing your insurer. Understanding their requirements and presenting a strong case are key.

Crafting A Convincing Appeal

Your appeal must stand out. Insurers receive numerous requests daily. A well-structured argument can set yours apart.

- Gather supporting documents: Clinical studies, prescription history, and previous treatment records form a solid base.

- Cite expert opinions: Include recommendations from healthcare professionals familiar with your case.

- Highlight Ozempic’s benefits: Emphasize how it goes beyond weight loss to improve overall health.

- Show cost-effectiveness: Prove that Ozempic may reduce future healthcare expenses.

Communicating The Medical Necessity

Insurers need to understand why Ozempic is essential for you.

- Define your medical condition: Clearly state the diagnosis that warrants weight loss.

- Explain unsuccessful alternatives: Show that other treatments haven’t worked for you.

- Link to professional guidelines: Reference standards that support using Ozempic for similar cases.

- Personalize your story: Briefly describe your struggle and how Ozempic can change your life.

Navigating Prior Authorization

Securing insurance coverage for medications like Ozempic for weight loss often hinges on navigating prior authorization, a step required by insurance companies to control costs for prescriptions not traditionally covered under standard drug plans.

Steps For Prior Authorization

Follow this clear path to sail through the prior authorization process:

- Consult with your healthcare provider to determine if Ozempic is right for you.

- Request documentation supporting your need for Ozempic as a weight loss treatment.

- Submit the prior authorization form provided by your insurer, filled out by your prescriber.

- Wait for the insurance’s response to the authorization request.

- If denied, consider an appeal with additional supporting documentation.

Tips For A Successful Submission

Boost your chances of approval with these insider tips:

- Accurate details: Ensure all information on forms is correct.

- Medical justification: Include detailed medical records and a letter of necessity.

- Follow-up: Stay proactive and check in with your insurer regularly.

- Persistence: Be ready to respond to additional requests or to contest rejections.

Steer through prior authorization efficiently and set the course for potentially securing coverage of Ozempic for your weight loss journey.

Alternative Funding Options

An unexpected expense like medication for weight loss can strain your budget. Thankfully, various alternative funding options can help manage the costs associated with Ozempic. Let’s dive into some of the ways to lighten the financial load.

Manufacturer Savings Programs

Manufacturer savings programs are a gift to your wallet. They can significantly reduce the price of Ozempic.

- Search for ‘Ozempic savings card’ online.

- Register for the program through the official Ozempic website.

- Show this card at your pharmacy.

Eligible patients could pay as little as $25 for a 1-month supply.

Patient Assistance Programs

Patient assistance programs (PAPs) offer additional help. Non-profit groups and foundations run these programs.

- Check eligibility, as it may vary based on income or insurance status.

- Apply through patient advocacy groups or the medication’s website.

- If approved, receive Ozempic at a reduced cost or even for free.

These programs aim to ensure no one goes without necessary medications.

Credit: www.everlywell.com

Legal Considerations And Rights

Understanding your legal considerations and rights is essential when trying to get insurance to cover Ozempic for weight loss. Knowing the insurance norms and patient rights can arm you with the needed knowledge to navigate this process effectively.

Insurance Laws And Patient Rights

Insurance regulations vary by state and policy. Familiarize yourself with specific laws regarding medication coverage. Insurers must abide by these laws. Knowing your patient rights is crucial. Ensure access to necessary medications like Ozempic. Boldly advocate for your health needs.

- Review your policy’s fine print to understand coverage specifics.

- Policies must cover FDA-approved medications for certain conditions.

- Understand exceptions and appeals processes for denied coverage.

When To Seek Legal Advice

If you face challenges with insurance coverage for Ozempic, consider getting legal advice. Denied claims or unclear policy terms warrant professional opinion. Legal experts can guide through appeals or disputes. Protect your right to necessary medication.

- Contact a lawyer if insurance denies your medication claim unjustly.

- Seek help for navigating complex insurance appeals.

- If your treatment requires immediate attention, do not delay in getting advice.

Patient Success Stories

Everyone loves an inspiring success story, especially when it comes to overcoming health challenges. Let’s delve into the lives of those who’ve navigated the complexities of insurance to obtain Ozempic for weight loss. Their journeys are not just stories; they are beacons of hope and manuals of strategy for anyone on a similar path.

Real-life Cases

Ozempic, a medication initially approved for managing diabetes, has shown promising results for weight loss. Kate’s story highlights this potential. Struggling with obesity, her doctor recommended Ozempic. Yet, her insurance company rejected her claim. Undeterred, Kate appealed the decision with her doctor’s support, citing medical necessity. Her perseverance paid off when her appeal succeeded and her treatments began.

John’s case adds another dimension. John learned that documentation is critical. He provided thorough medical records and a precise treatment plan from his doctor. This preparation enabled his insurance provider to understand the urgency of his situation. John’s commitment to detail ultimately led to his insurance covering Ozempic for his weight loss journey.

Lessons Learned

- Start by understanding your policy in detail. Know its terms and coverage limits.

- Work closely with your doctor to collect evidence of medical necessity.

- Be prepared to appeal a denial. Persistence can change the outcome.

- Keep all communications with your insurance provider written and well-documented.

Through these experiences, the overarching lesson is clear: securing insurance coverage for a drug like Ozempic is not just about persistence, but also about partnership with healthcare professionals and meticulous documentation.

Future Of Weight Loss Drugs And Insurance

The landscape of weight loss medications is evolving rapidly. It prompts a close look at the future of prescription drugs like Ozempic and their coverage through insurance. Weight loss is a pressing health concern. Innovative drugs such as Ozempic play a pivotal role in managing obesity. Yet, questions linger about their insurance coverage and accessibility. Peering into the possibilities may offer a glimpse into a future where these obstacles ease, benefiting those in need of these medications.

Trends In Healthcare Coverage

Insurers regularly review the treatments they cover. This includes weight loss drugs. As obesity’s impact on health becomes clearer, more insurers are considering the inclusion of these drugs in their plans. Here’s what you should know:

- Preventive Health Focus: Insurance companies are shifting towards preventing illnesses. Weight loss drugs may become part of standard coverage.

- Policy Changes: Advocacy and health data are driving policy updates. This potentially broadens coverage for weight loss medications.

- Cost-Effectiveness: Long-term savings from improved health might tip the scales. Insurers could see these drugs as wise investments.

Emerging Treatments And Policies

New treatments like Ozempic emerge regularly. These advancements challenge existing insurance policies. Providers and patients alike watch keenly for these changes:

- Innovative Drugs: Research churns out more sophisticated weight loss drugs. These could prove irresistible for insurance providers to cover.

- Policy Discussions: Stakeholders are actively debating coverage for weight loss medications. Positive shifts in this discourse could expand access to Ozempic.

- Healthcare Incentives: Governments are offering incentives to insurers. This encourages the inclusion of vital weight loss treatments in coverage plans.

Credit: www.wsj.com

Frequently Asked Questions

How To Get Ozempic Covered By Insurance For Weight Loss?

Consult your healthcare provider for a prescription tailored for weight loss. Verify coverage with your insurance provider. Provide necessary medical documentation to justify the prescription. Discuss with your pharmacist or benefit coordinator for assistance. Appeal if initial claims get denied.

How Do I Get Ozempic Approved For Weight Loss?

To get Ozempic approved for weight loss, consult your healthcare provider. They will assess your eligibility and may prescribe it if you meet FDA guidelines for body weight and related medical conditions. Ensure insurance coverage by verifying your plan’s policy on weight management medications.

What Do I Need To Say To Qualify For Ozempic?

To qualify for Ozempic, discuss your type 2 diabetes management goals with your doctor. Mention any struggle with weight control as Ozempic can help with both blood sugar levels and weight loss. Ensure you meet the prescription criteria before starting treatment.

How Do I Get 3 Months Of Ozempic For $25?

Eligible patients can get 3 months of Ozempic for $25 through the Ozempic® Savings Card program. Sign up on the official Ozempic website to redeem this offer.

Conclusion

Navigating insurance coverage for Ozempic as a weight loss solution can be a challenge. Yet, with persistence and the right strategy, approval is within reach. Remember to consult with your healthcare provider, understand your policy specifics, and prepare a compelling case.

Taking these steps increases the likelihood of your treatment being covered, making your health goals more achievable.