Health insurance may cover medical costs from car accidents, but it often depends on the policy. Personal Injury Protection or MedPay is typically designated for these cases.

Understanding the interplay between health insurance and auto insurance is essential, particularly as it relates to car accidents. Navigating the aftermath of a car accident involves addressing physical injuries and financial implications. While auto insurance usually steps in first to cover injuries from a car accident, health insurance can play a crucial role, especially where auto insurance coverage limits are reached.

It’s imperative to review both your health and auto insurance policies to determine the extent of coverage and the process for filing claims after an accident. Proactive policyholders strive to grasp the nuances of their coverage to prevent unexpected out-of-pocket expenses.

Credit: sinasdramis.com

Introduction To Navigating Health Insurance And Car Accidents

Navigating health insurance and car accidents can be confusing and stressful. When an accident happens, questions about coverage and costs arise. Understanding how your health insurance works with car accident claims is essential. This guide aims to simplify this process, providing clarity on the initial steps to take and the important questions to ask.

Initial Considerations

After a car accident, the priority should be health and safety. Even if injuries are not apparent, seeing a doctor is critical. Medical records play a vital role in any claims process. Once immediate health concerns are addressed, it’s time to examine your health insurance policy. Find out what types of injuries and treatments are covered and understand how car insurance and health insurance may interact.

Key Questions To Ask

As you delve into the details of your coverage, consider these key points:

- Does your health insurance cover auto accident injuries?

- What is the extent of the coverage?

- Who is at fault, and how does that affect your coverage?

- Is there a need to pay a deductible?

- How do you file a claim with your health insurance?

Each of these questions can lead you through the complexities of managing health care expenses after a car accident.

Types Of Health Insurance Policies And Coverage

The aftermath of a car accident can bring a whirlwind of questions. One pressing concern is whether health insurance covers such events. Let’s explore the different types of health insurance policies and their coverages to understand how they may protect you in the case of an automobile incident.

Private Health Insurance

Private health insurance is a plan you purchase on your own. It is not tied to your job. Different plans offer varying levels of coverage. Some key points include:

- Emergency services: Most plans will cover emergency care, which can include car accident injuries.

- Deductibles and copays: After an accident, you may have to pay these before your plan starts paying.

- Exclusions: Always check your policy. Some may not cover car accidents.

Employer-sponsored Plans

Many people get health insurance through their jobs. These are called employer-sponsored plans. They often offer benefits including:

| Coverage | Benefit |

|---|---|

| Comprehensive care | Covers a wide range of health issues, from accidents to regular checkups. |

| In-network providers | You may need to choose doctors within your plan’s network after an accident. |

| Prescription drugs | Post-accident medications often fall under your prescription drug coverage. |

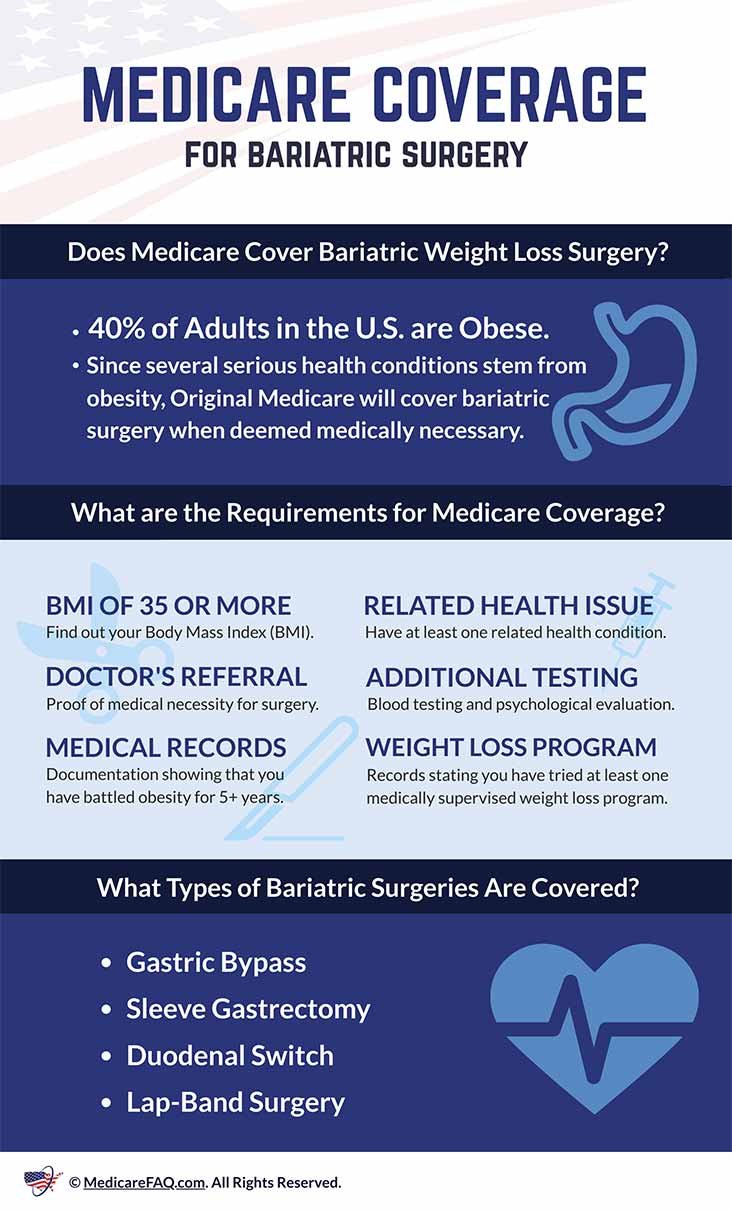

Government Health Programs

Government programs like Medicare or Medicaid also provide health coverage. They have special rules. Below are some details:

- Medicare often covers car accident-related injuries for those eligible, but remember, there is a deductible.

- Medicaid coverage for car accidents can vary by state, so it’s essential to check your state’s rules.

- Both programs might seek reimbursement from car insurance settlements, so it’s important to understand your policy.

Understanding Auto Insurance Medical Coverage

Car accidents can be stressful. One big question is: who pays for medical bills? It’s important to understand your insurance. This will help in such tough times. Let’s dive into how auto insurance provides medical coverage.

Personal Injury Protection (pip)

Personal Injury Protection, often called PIP, is an auto insurance feature. It helps pay for medical costs from car accidents, regardless of who is at fault. PIP coverage is not available in all states. In states that offer it, PIP can cover the following:

- Medical expenses

- Lost wages

- Funeral costs

- Substitute services (like childcare if you’re unable to provide it due to injury)

In some states, PIP is mandatory. In others, it’s optional. Know your state’s laws and choose coverage to protect yourself and your loved ones.

Medical Payments Coverage (medpay)

Medical Payments Coverage, or MedPay, helps with medical expenses from a car accident. MedPay works no matter who caused the accident. It’s simpler than PIP. It covers things like:

- Surgery and X-rays

- Ambulance and EMT fees

- Hospital visits and stays

- Professional nursing services

MedPay is optional in most states but offers an added layer of protection. It’s wise to assess if MedPay fits your needs for peace of mind on the road.

Credit: denmonpearlman.com

When Health Insurance Steps In

Navigating the aftermath of a car accident can be overwhelming. The question of who pays for medical costs is a common concern. In certain situations, health insurance becomes a safety net. This happens when auto insurance falls short or is non-existent. Understanding how your health insurance interacts with other types of coverage is crucial. It ensures you’re prepared financially regardless of the scenario. Let’s delve into instances where health insurance steps in after a car accident.

Accidents With No Auto Insurance

Owning a car without insurance is risky. But it can happen either by choice or oversight. It’s important to know how your health insurance may respond here. When there’s no auto insurance in the picture, your health policy might cover medical expenses from the accident. Coverage is subject to your plan’s limitations and deductibles. Make sure to review your policy details or speak with your insurance provider for specifics on coverage.

High Deductibles And Out-of-pocket Costs

High deductibles can create financial pressure when you’re facing medical bills after a car accident. Your health insurance may take over after your auto insurance has reached its limit. But you’ll still need to satisfy the deductible on your health plan before it starts to pay. Keep in mind that even after meeting your deductible, co-pays and coinsurance may still apply. Below is a breakdown of potential out-of-pocket costs with health insurance:

- Deductible: The amount you pay before your insurance kicks in.

- Copayment: A fixed fee for a covered service, paid each time you receive that service.

- Coinsurance: The percentage of costs you pay after your deductible is met.

- Out-of-Maximum: The most you’ll have to pay in a policy period before your insurance covers 100%.

The Coordination Of Benefits

Understanding the ‘The Coordination of Benefits’ is key after a car accident. Your health insurance may cover your medical bills. Yet, the way it coordinates with car insurance policies can be complex. Navigating this system is crucial to avoid paying out of pocket.

Primary Vs. Secondary Insurance

When involved in a car accident, identifying your primary and secondary insurance is vital. Your auto insurance usually covers you first. This is known as the primary insurer. Your health insurance kicks in only after exhausting your car insurance benefits.

- Primary Insurance: The insurance that pays first is your car insurance’s personal injury protection (PIP) or medical payments coverage.

- Secondary Insurance: This is your health insurance, which may cover remaining costs after your auto insurance limits are met.

The Subrogation Process

Subrogation is an insurance process that affects payouts after an accident. Your health insurer may pay for your treatment initially. They may then seek repayment from the at-fault driver’s insurance company.

- Health Insurer Pays: Your health insurance covers your medical claims post-accident.

- Claim Against At-fault Party: Your insurer may reclaim these costs from the party responsible for the accident.

Understanding these processes can ease your financial stress after an accident. It ensures you receive the benefits you are entitled to without unnecessary payments.

Credit: www.michiganautolaw.com

Situational Considerations

Situational considerations play a crucial role in determining whether health insurance covers car accidents. The coverage can vary widely depending on where the crash occurred and the specific details of both your health and auto insurance policies. It’s essential to understand how these factors interplay to ensure you’re adequately protected in case of an accident.

At-fault Vs. No-fault States

Different states have different rules for car accidents. In at-fault states, the driver who caused the crash is responsible for paying for damages, usually through their auto insurance. Here, your health insurance may step in to cover medical expenses until the at-fault driver’s insurance pays out.

Conversely, no-fault states require that each person’s auto insurance pays for their medical expenses regardless of who caused the crash. This system can limit the need to use health insurance for accident-related injuries.

Uninsured And Underinsured Motorist Coverage

This type of coverage is crucial when the at-fault driver lacks sufficient insurance. Uninsured motorist coverage protects you if the other driver has no insurance. Underinsured motorist coverage steps in when the at-fault driver’s liability limits are too low to cover the medical expenses.

Your health insurance might be used after these coverages have been exhausted. It’s important to check your policy for the specifics of these situations.

Navigating Claim Processes And Disputes

If you’re in a car accident, navigating the insurance maze can be daunting. The question of whether health insurance covers car accidents adds another layer of complexity. Understanding the claims process and knowing how to handle disputes are critical for a smooth experience.

Filing A Claim

Time is key post-accident. First, check your health insurance policy for cover details. You may need to notify your provider about the accident. Insurance cards have a support number for your convenience.

- Gather all necessary information such as medical reports and accident details.

- Submit your claim as per the guidelines provided by your health insurer.

- Keep records of any medical treatments and receipts because they are essential for claims.

Car insurance might step in first, depending on your state’s regulations and your policy details. So, understanding your cover helps in choosing the right course for claim filing.

Dealing With Denials And Appeals

Claim disputes can be sticky. An insurance denial isn’t the end, though. It’s possible to file an appeal. Start by reviewing the denial letter closely to understand the reason.

| Step | Action |

|---|---|

| 1 | Check denial reasons |

| 2 | Collect all supporting documents |

| 3 | Contact insurance for clarification |

| 4 | File appeal before the deadline |

Seeking assistance from a legal advisor or claims specialist might prove beneficial. Persistence often pays off in appeals. Always respond in a timely manner to requests for additional information.

Preventative Measures And Safe Practices

Dealing with health insurance after a car accident can be complex. To ensure you’re protected, adopt essential preventive measures. Practices like knowing your policy well and driving safely reduce risks significantly. Let’s dive deep into how you can stay ahead.

Reviewing Policy Details Regularly

Understanding your health insurance policy is a preventative measure you should not ignore. Be aware of what your health insurance covers in the event of a car accident.

Set a reminder to review your policy every year. Look for changes in coverage, limits, and deductibles. This way, you’re never caught off guard.

- Check coverage for:

- Emergency services

- Post-accident rehabilitation

- Injury treatment

- Understand exclusions.

- Know your rights before you need them.

Safe Driving Tips

Practice safe driving to vastly lower the risk of car accidents. Stick to basic safety rules and keep the roads safer for everyone.

| Tip | Description |

|---|---|

| Wear Seatbelts | Reduces risk of serious injury |

| Obey Speed Limits | Keeps you in control |

| Avoid Distractions | Focus on driving, not devices |

| Regular Maintenance | Ensures car safety and reliability |

| Drive Sober | Keeps your reflexes sharp |

Consulting The Professionals

Navigating through the aftermath of a car accident can be complex. Medical costs pile up quickly. Often, it’s not clear if health insurance will cover these expenses. This is when professional advice becomes invaluable. Knowing when to consult a lawyer and understanding the role of insurance adjusters are crucial steps.

When To Consult A Lawyer

Seek legal advice immediately after an accident. especially if there are injuries or significant property damage. Lawyers can help navigate the often-confusing insurance claims process. They ensure that your rights are protected. A lawyer will also advise on whether your health insurance or the at-fault party’s insurance should cover your medical bills.

The Role Of Insurance Adjusters

Insurance adjusters represent the insurance company. They assess the accident and determine the compensation amount. It’s vital to remember that adjusters work for the insurance company’s interest. They aim to minimize the company’s liability. Knowledge of this helps you negotiate better or decide when to get a lawyer involved.

When dealing with insurance adjusters, keep these points in mind:

- Documentation is key: Keep all records of medical visits and expenses.

- Honesty matters: Be truthful about the accident and your injuries.

- No rush: Don’t settle your claim until you understand the long-term impacts.

Frequently Asked Questions

Who Pays Medical Bills After A Car Accident In Texas?

In Texas, the at-fault driver’s insurance typically pays for medical bills after a car accident. Your own insurance may cover expenses if the at-fault driver is underinsured.

Does Health Insurance Cover Auto Accident Injuries In Texas?

Health insurance in Texas typically covers injuries from auto accidents. Confirm with your policy for specific coverage details.

What Are The Accident Benefits In Texas?

Accident benefits in Texas include medical expenses, income replacement, and death benefits. Coverage depends on the policyholder’s auto insurance plan. These benefits help victims manage post-accident financial burdens.

What Pays You For Injuries Caused To You By A Hit And Run Driver?

Uninsured motorist coverage on your auto insurance policy may pay for injuries in a hit-and-run incident. Your personal injury protection (PIP) or medical payments coverage could also provide compensation.

Conclusion

Navigating the intersection of health insurance and car accidents can be intricate. Assurance typically hinges on specific policy details and state laws. Secure peace of mind by reviewing your coverage and consult with your insurer. Knowledge is power in safeguarding your financial health after an automotive mishap.

Always drive safely and stay informed.