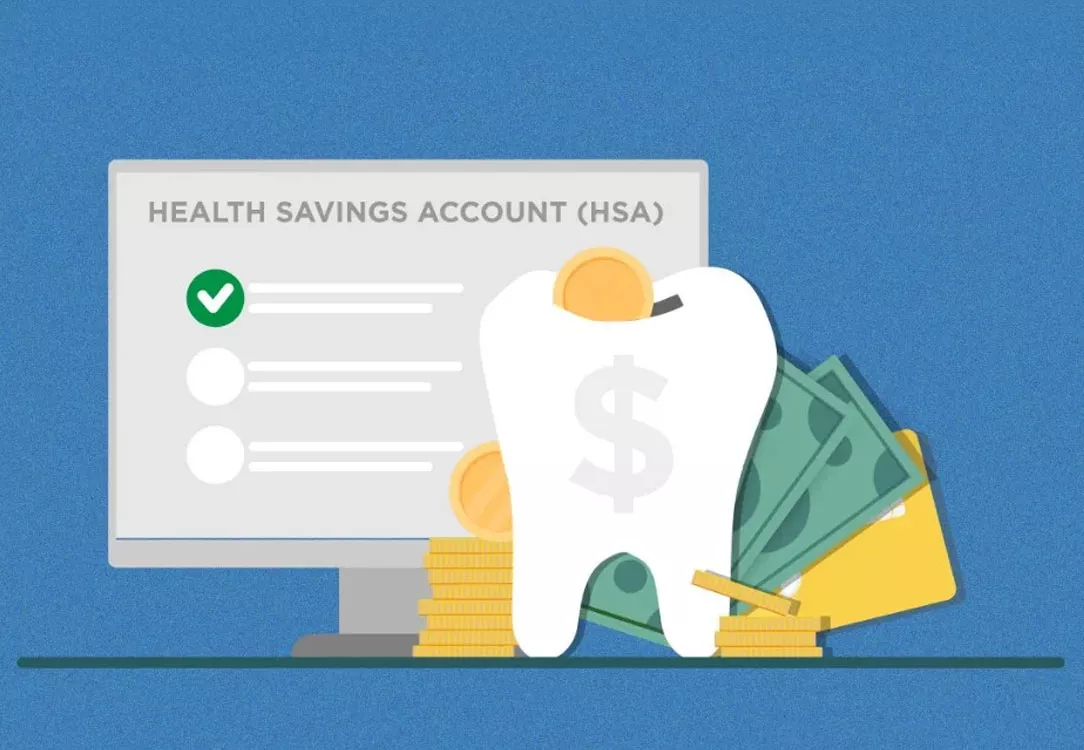

Yes, a Health Savings Account (HSA) can be used for dental expenses. Eligible dental expenses include treatments such as cleanings, fillings, and braces.

Managing your healthcare finances effectively is crucial in today’s high-cost medical landscape. An HSA provides a tax-advantaged way to save and pay for various health-related expenses. One of the lesser-known benefits of an HSA is its applicability to dental care, an essential aspect of overall health.

Not only does using an HSA for dental expenses help manage out-of-pocket costs, but it also maximizes the potential tax savings associated with these accounts. Eligible dental expenses typically cover preventive care, diagnosis, and treatments that address dental health. It’s vital for account holders to understand the flexibility offered by HSAs, as it extends beyond general medical expenses and includes essential dental treatments that maintain oral health and prevent more severe conditions.

Hsas And Dental Care Essentials

Peeking into the world of health savings, we unearth gems for your dental care. An HSA could be your budget booster for keeping your smile shiny and healthy. Let’s dive right into how HSAs work and if they cover those crucial dentist visits.

The Abcs Of Health Savings Accounts

An HSA stands for a Health Savings Account. It’s a special account for people with high-deductible health plans. This account lets you save money, tax-free, for medical expenses.

Simple rules drive HSAs: save, spend, and enjoy the tax benefits. You get to roll over the balance year-on-year, too. No ‘use it or lose it’ here.

- Save: Put pre-tax money in your HSA. This lowers your taxable income.

- Spend: Use the money for qualified health costs, including dental care.

- Tax Benefits: Money grows free from taxes. Withdrawals for medical costs are also tax-free.

Dental Expenses: A Qualified Hsa Spending Category?

Yes, HSAs cover dental treatment. They handle costs not typically covered by health insurance. This can include cleanings, fillings, and braces.

Regular dental check-ups are essential, and HSAs make them easier on your wallet. Preventive dental care is key to avoiding costly treatments later. HSAs are here to help.

| Qualified Dental HSA Expenses |

|---|

| Cleanings and exams |

| X-rays |

| Fillings and crowns |

| Orthodontics |

Remember, cosmetic procedures like teeth whitening aren’t HSA-eligible. Check with your HSA provider for a detailed list of what’s covered to plan accordingly.

:max_bytes(150000):strip_icc()/20-ways-use-your-flexible-spending-account_final_rev-d861e123d8b64ced89a51a3b178f7fc4.png)

Credit: www.investopedia.com

Eligibility Criteria For Hsa Use In Dental Care

Understanding the Eligibility Criteria for HSA Use in Dental Care is crucial for managing healthcare expenses wisely. Health Savings Accounts (HSAs) serve as a financial aid for various medical costs. Tooth care is no exception. Let’s decode the criteria and explore how you can use your HSA to keep your smile bright and healthy.

Qualifying For An Hsa

To open an HSA, you must have a High Deductible Health Plan (HDHP). An HDHP typically carries a higher annual deductible than other health insurance plans. The Internal Revenue Service (IRS) sets specific criteria each year to define an HDHP. You cannot be claimed as a dependent on another person’s tax return. Also, you must not have any other health coverage that isn’t an HDHP. Importantly, enrollment in Medicare disqualifies you from starting an HSA.

Eligible Dental Expenditures

Your HSA funds cover a variety of dental expenses. Within IRS regulations, these are expenses necessary to prevent or alleviate dental disease. Preventative services like cleanings, sealants, and fluoride treatments are HSA-eligible. Fundamental procedures including fillings, extractions, and dentures also qualify. Orthodontia, including braces and Invisalign, is also eligible when medically necessary.

| Preventative Care | Basic Procedures | Major Services |

|---|---|---|

| Cleanings | Fillings | Crowns |

| Sealants | Extractions | Root Canals |

| Fluoride Treatments | Dentures | Orthodontia |

Remember, cosmetic procedures like teeth whitening do not qualify. The IRS provides a detailed list of qualified medical expenses in Publication 502, which includes permissible dental costs. Check this document before using your HSA funds to be sure your dental expenses are covered.

Maximizing Your Hsa For Dental Health

An HSA is a powerful tool for managing dental health costs. Funds can be used for various dental expenses. Understanding how to leverage your HSA can lead to substantial savings. Ready to unlock your HSA’s full potential for your pearly whites? Dive into strategic savings and smart spending with these tips!

Strategic Contributions

Contributions to your HSA are tax-deductible. They grow tax-free. Making smart contributions can boost your dental health budget considerably. Start by reviewing your annual dental costs. Plan to contribute enough to cover those expenses within your HSA. Below are key points to consider when contributing strategically:

- Assess your dental care needs – Regular check-ups or any foreseen dental work in the future should factor into how much you contribute.

- Family contributions – If your plan allows, contribute for family members’ dental expenses as well.

- Maximize employer contributions – Some employers match HSA contributions. This can double the funds available for dental expenses.

- Adjust annually – Health and dental needs may change. Adjust your contribution every year accordingly.

Smart Withdrawals For Dental Expenses

HSAs can cover a range of dental treatments. This includes fillings, crowns, and orthodontics. Here are tips for making the most of your HSA by planning smart withdrawals:

- Determine eligible expenses – Check which dental expenses qualify for HSA use to avoid penalties.

- Timing matters – If possible, time procedures to match your HSA balance to avoid out-of-pocket expenses.

- Keep receipts – Document all expenses made through your HSA for record-keeping and tax purposes.

- Link to dental insurance – Combine HSA funds with dental insurance to stretch your dental care budget further.

Credit: www.centralbank.net

Navigating Irs Rules On Dental Expenses

Understanding how you can use a Health Savings Account (HSA) for dental costs involves sifting through the IRS rules. Let’s explore these guidelines to make sure you use your HSA effectively for your dental expenses.

Irs Definitions Of Qualified Dental Expenses

The IRS has clear criteria for HSA-eligible dental costs.

- Preventive care like cleanings and sealants is covered.

- Restorative work such as fillings and crowns is included.

- Orthodontic treatments, including braces, also qualify.

- Procedures like root canals and extractions are eligible.

Dental products or services for cosmetic purposes do not qualify.

Common Misconceptions And Exclusions

Many people think all dental-related expenses are HSA eligible, but that’s not true.

Teeth whitening is a common exclusion, alongside cosmetic veneers.

Here are some other important exclusions:

| Non-Qualified Item | Reason for Exclusion |

|---|---|

| Toothbrushes and toothpaste | Deemed as general health items, not specific treatments. |

| Mouthwash and dental floss | Considered personal hygiene items. |

Ensure you consult the latest IRS guidelines or speak with a tax professional before purchasing.

Dental Procedures Covered Under Hsa

Dental health is crucial for overall well-being. Understanding how your Health Savings Account (HSA) caters to dental care can save you money. Here’s a guide on what dental procedures your HSA covers, ensuring your smile remains a priority.

Routine Check-ups And Cleanings

Preventative dental care is vital for long-term oral health. Fortunately, your HSA funds can be used for:

- Annual exams: These are essential to monitor oral health.

- Teeth cleanings: A regular hygiene staple, usually recommended twice a year.

- X-rays: They help detect issues not visible during a routine exam.

- Fluoride treatments: Often used in children for cavity prevention.

- Sealants: A preventive measure to keep cavities at bay.

Oral Surgeries And Emergency Dental Work

An HSA can also cover more complex dental work. This includes:

- Tooth extractions: Necessary when teeth are beyond repair.

- Root canals: To treat infected or damaged teeth.

- Gum surgery: For severe gum disease or to enhance the appearance of your gum line.

- Dental implants: They replace missing teeth and offer a long-term solution.

- Emergency procedures: Covers unexpected dental issues, like a broken tooth.

Tips To Leverage Hsa For Orthodontics

Navigating the financial side of dental health, specifically orthodontics, can seem overwhelming. Fortunately, Health Savings Accounts (HSAs) can be a powerful tool. Properly leveraging an HSA can make a significant impact on managing the costs associated with orthodontic care. From braces to aligners, understanding how to use your HSA effectively could lead to smarter investment decisions for your dental health. Below are some vital tips to get the most out of your HSA for orthodontic services.

Braces And Aligners: A Smart Investment

Orthodontic treatments such as braces and aligners not only improve dental health but also boost self-confidence. While these treatments may initially seem expensive, utilizing an HSA can substantially lower your out-of-pocket costs. Here’s how:

- Check your HSA eligibility: Verify that your orthodontic treatment is a qualified medical expense.

- Review your plan details: Some plans may have specific stipulations about orthodontic care.

- Keep receipts: Always save your payment receipts for tax purposes and HSA reimbursement.

Planning Hsa Contributions For Orthodontic Care

Managing your HSA contributions can ensure you have the funds you need when you need them.

- Estimate costs ahead of time: Get a treatment plan from your orthodontist to understand future expenses.

- Adjust your contributions: Based on estimated costs, you might want to increase your HSA contributions.

- Utilize employer contributions: If your employer offers HSA contributions, factor these into your plan.

Strategically allocate your HSA funds for a smarter approach to financing orthodontic procedures like braces and aligners. These steps can offer peace of mind and reduce stress around dental expenses.

Staying Informed: Updates On Hsa Eligibility For Dental

Understanding how to use a Health Savings Account (HSA) for dental expenses is crucial. Tax-free dollars can cover many dental procedures. This section details the latest HSA updates for dental care.

Keeping Abreast With Irs Guidelines

IRS rulings directly impact HSA use. Changes occur yearly. Being up to date ensures compliance and maximizes benefits. Review the IRS publication for HSA specifics annually.

- Verify eligible dental expenses.

- Understand contribution limits.

- Check for new updates.

Consulting With Hsa Experts

Professional advice brings clarity to HSA matters. Reach out to HSA consultants for personalized guidance. They help navigate expense eligibility and optimal HSA usage.

- Schedule a consultation.

- Prepare questions.

- Discuss recent changes.

Case Studies: Real-life Hsa Use For Dental Costs

Welcome to our Case Studies: Real-Life HSA Use for Dental Costs section. Here, we explore actual scenarios where Health Savings Accounts (HSAs) played a pivotal role in managing dental expenses. Discover the wins and learn from the errors of others to optimize your HSA for oral health costs.

Success Stories With Hsa Dental Financing

- Sarah’s Orthodontic Victory: Sarah used her HSA funds to cover braces for her 12-year-old. She saved up for two years, avoiding high interest rates on credit cards.

- Mike’s Wisdom Tooth Win: A surprise wisdom tooth extraction could have set Mike back financially. His HSA covered the full cost, keeping his savings intact.

Learning From Mistakes: What To Avoid

- Dave’s Documentation Slip: Dave forgot to keep his dental receipts. He couldn’t prove his HSA spending. Always save your dental expense receipts.

- Emily’s Eligibility Error: Emily used her HSA for cosmetic dentistry, which isn’t covered. Check which dental procedures your HSA covers before spending.

Future Of Dental Care With Hsas

Taking care of your teeth could get easier with Health Savings Accounts (HSAs). These accounts help you save for medical costs. They cover many dental services. Using HSAs for dental needs might change soon. Technology could make managing these accounts simpler. Let’s explore what’s on the horizon for HSAs and dental care.

Potential Changes In Hsa Regulations

- Limits may rise – You could save more each year.

- New rules might start – They could let you spend HSA money in new ways.

- Dental coverage could expand – More treatments might get included.

Expect to see these changes soon. They aim to make dental care more affordable. Check what your HSA covers regularly.

The Role Of Technology In Hsa Management

Apps track spending – A quick glance tells where your money goes.

Online tools help plan – Tools show how much to save for a healthy smile.

Alerts keep you updated – Get notifications for dental check-ups and payments.

New tech makes HSAs easier to use. It helps you get the most from your account.

:max_bytes(150000):strip_icc()/hsa.asp-final-9b3f314e10b44ee5b645055dd926a8ad.png)

Credit: www.investopedia.com

Frequently Asked Questions

Can I Use My Hsa Card At The Dentist?

Yes, you can use your HSA card to pay for qualified dental expenses, including treatments and procedures at the dentist. Ensure your services are HSA-eligible.

Can I Use My Health Savings Account For Veneers?

Yes, you can use your health savings account (HSA) for dental veneers if they are considered a qualified medical expense. Check with your HSA administrator for specific coverage details.

Can I Use My Hsa For Teeth Whitening?

No, you cannot use your HSA for teeth whitening as it is considered a cosmetic procedure and not a qualified medical expense.

Can I Use My Hsa For Wisdom Teeth Removal?

Yes, you can use your Health Savings Account (HSA) to pay for wisdom teeth removal, as it is considered a qualifying dental expense.

Conclusion

Wrapping up, Health Savings Accounts offer notable flexibility for managing dental costs effectively. Leveraging an HSA for oral care is not only wise but also thrifty, maximizing your healthcare budget. Remember to review eligible expenses and consult your plan details to make informed decisions for your dental health.