Ace Medicare Supplement provides additional health coverage for Medicare enrollees. It helps cover out-of-pocket expenses not paid by Medicare.

Navigating the complexities of healthcare can be daunting, especially as we age. Medicare offers a fundamental layer of insurance, but it often falls short of covering all medical expenses. That’s where Ace Medicare Supplement steps in, bridging the gap between what Medicare pays and the actual cost of medical care.

This supplemental insurance is a lifeline for those seeking financial cushioning against unforeseen health issues. It offers peace of mind, knowing you’re protected from excessive out-of-pocket expenses. With Ace Medicare Supplement, beneficiaries gain control over their healthcare finances, ensuring they can access the care they need without the burden of crippling costs.

Introduction To Ace Medicare Supplement Plans

Understanding Ace Medicare Supplement plans is essential for optimal healthcare coverage. These plans fill gaps left by traditional Medicare, covering additional expenses like copayments, coinsurance, and deductibles. With Ace Supplemental coverage, individuals gain the assurance of comprehensive healthcare without unexpected out-of-pocket costs.

Choosing Ace Medicare Supplement brings numerous benefits. It offers a range of plans tailored to individual needs, ensuring you only pay for the coverage you require. The flexibility to choose your healthcare providers is a significant advantage, granting you freedom and control over your medical care decisions.

| Benefit | Description |

|---|---|

| Financial Security | Limits out-of-pocket expenses |

| Provider Choice | Freedom to select doctors |

| Customized Plans | Tailored to personal needs |

Types Of Ace Medicare Supplement Plans

Ace Medicare Supplement Plans offer diverse options to fit individual health care needs. Each plan is designated by a letter, such as Plan A, Plan B, Plan C, and so forth. Key differences among them include the extent of coverage and specific benefits offered. For instance, some plans may cover Medicare Part A deductibles fully, while others might provide partial or no coverage.

| Plan Letter | Coverage | Benefits |

|---|---|---|

| A | Basic | Essential benefits |

| B | Basic+ | Part A deductible |

| C | Extended | Foreign travel emergency |

Selecting the right Ace Medicare Supplement Plan is crucial. Each lettered plan presents a unique blend of coverage and benefits. Individuals must review their health needs to choose the best option. Plan F stands out for its comprehensive coverage, while Plan K offers lower premiums with a cost-sharing approach.

Eligibility Criteria For Enrollment

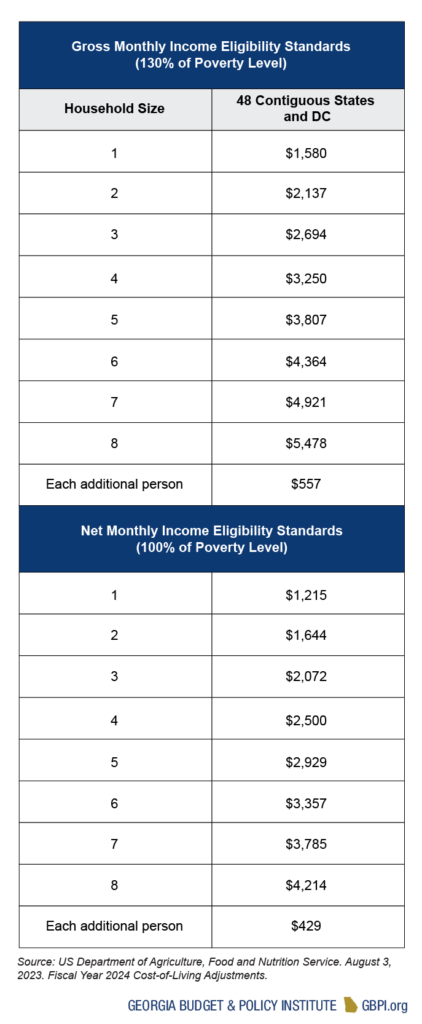

To enroll in Ace Medicare Supplement, individuals must be 65 years or older. Certain younger people with disabilities or those with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD) may also qualify. The key enrollment periods include the Initial Enrollment Period (IEP), which starts three months before turning 65 and ends three months after the birthday month.

General Enrollment Period (GEP) runs from January 1 to March 31 each year. For those who miss IEP, the Special Enrollment Period (SEP) provides another chance under specific circumstances. Annual Election Period (AEP), from October 15 to December 7, allows for changes in plans. Missed deadlines can lead to delayed enrollment and potential penalties.

Credit: saversmarketing.com

Cost Considerations And Saving Tips

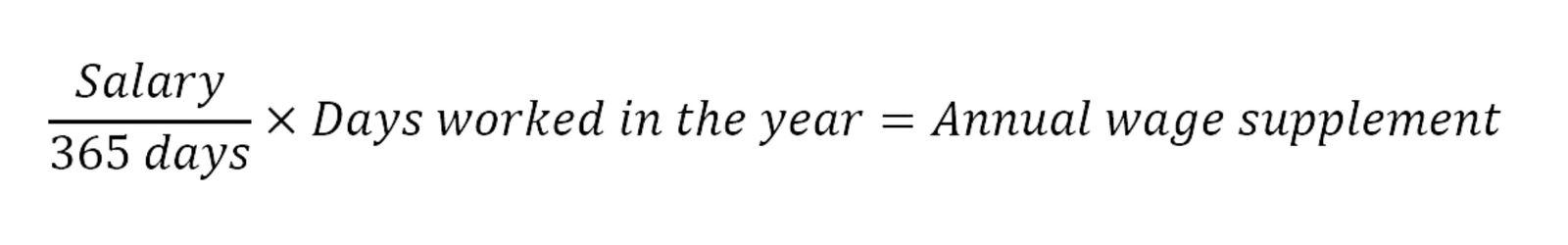

Understanding premiums, deductibles, and co-pays is key to managing costs. Medicare Supplement plans vary in price. Each plan offers different levels of coverage and cost. Monthly premiums and yearly deductibles influence your out-of-pocket expenses.

To save on these costs, compare plans carefully. Choose one that fits your health needs and budget. Seek plans with lower co-pays for frequent services. Some insurers offer discounts for yearly payment or automatic bank deductions.

Always review your plan during the annual enrollment period. Changes in health needs might mean a different plan could save you money. Talk to a licensed insurance advisor to understand your options better. They can guide you to the most cost-effective choices.

Navigating The Claims Process

Ace Medicare Supplement simplifies the claims process for policyholders. To file a claim, ensure you have your policy number and healthcare provider’s information ready. Submit claims promptly to avoid delays. Your claim forms should be accurate and complete.

When dealing with multiple insurance plans, Ace coordinates benefits seamlessly. This means your out-of-pocket costs can be significantly reduced. Always provide details of any additional coverage you have. This helps Ace work efficiently with other insurers.

| Step | Action Required |

|---|---|

| 1 | Review your policy’s coordination benefits. |

| 2 | Inform Ace of other insurance policies. |

| 3 | Submit all relevant documents. |

| 4 | Await notification of benefits handling. |

Comparing Ace To Other Providers

Ace Medicare Supplement stands out in a crowded marketplace. With competitive rates and comprehensive coverage, it rivals top industry players. Users praise its straightforward claims process and reliable customer support. Diverse plan options cater to different needs, ensuring personalized healthcare solutions.

Customer reviews highlight satisfaction with Ace’s cost-saving benefits and flexible policies. Their experiences reflect confidence in Ace’s ability to provide peace of mind. This is critical for those seeking a secure healthcare future.

| Provider | Plans Offered | User Rating |

|---|---|---|

| Ace Medicare Supplement | Multiple | High |

| Competitor A | Limited | Medium |

| Competitor B | Varied | Low |

By comparing, consumers notice Ace’s dedication to quality service and affordability. These factors make Ace a preferred choice for Medicare supplements.

Additional Benefits And Features

Ace Medicare Supplement plans include several value-added services. Members gain access to 24/7 telehealth services, allowing for convenient health consultations from home. There’s also a personalized wellness program tailored to individual health needs.

The plans are at the forefront with innovative features. For instance, they offer flexible plan options that adapt to changing health requirements. This adaptability ensures that coverage meets the current needs of members.

Credit: coverright.com

Making An Informed Decision

Choosing the right Medicare Supplement plan involves careful evaluation. Costs, benefits, and provider flexibility are key components to weigh. It’s crucial to assess your current health needs and predict potential changes. Policy coverage should align with your healthcare habits and financial situation.

Compare plans to determine which offers the best value for your lifestyle. Seek advice from licensed professionals who specialize in Medicare. They can clarify details and help navigate the selection process. Detailed plan comparisons and state-specific information are available through the official Medicare website or state health insurance assistance programs.

| Factor | Details to Consider |

|---|---|

| Monthly Premiums | Assess affordability and budget impact. |

| Out-of-Pocket Costs | Include deductibles and co-payments. |

| Benefits | Ensure necessary services are covered. |

| Provider Network | Check if preferred doctors are accessible. |

Future Of Medicare Supplement Plans

The healthcare landscape is evolving rapidly. Medicare Supplement Plans, often known as Medigap, are no exception. Technological advancements and regulatory changes are shaping the future of these plans.

Experts anticipate a shift towards more personalized coverage options. This will cater to individual health needs. Data analytics will play a key role in customizing plans. Ace Medicare Supplement is expected to integrate these innovations.

There will likely be increased competition among providers. This will drive improvements in service and cost efficiency. Consumers can expect more value for their money. The Ace Plan may offer enhanced benefits at competitive prices.

With an aging population, the demand for comprehensive coverage is growing. Ace Plan is poised to meet this demand. It will provide peace of mind and financial protection against rising healthcare costs.

Credit: www.newhorizonsmktg.com

Frequently Asked Questions

Is Ace A Good Medicare Supplement?

Ace Medicare Supplement plans offer comprehensive coverage, often filling gaps in Original Medicare, making them a valuable option for many beneficiaries seeking additional health insurance support.

What Is Medicare Ace?

Medicare ACE is an acronym for “Medicare Administrative Contractor (MAC) Efficiency. ” It represents a set of best practices aimed at improving the efficiency of MACs in administering Medicare claims and services.

What Happened To Ace Insurance Company?

Ace Insurance Company merged with Chubb Limited in 2016 to form the world’s largest publicly traded property and casualty insurance company.

What Is The Most Popular Supplement Plan For Medicare?

The most popular Medicare supplement plan is Plan F, known for its extensive coverage.

Conclusion

Choosing the right Medicare Supplement plan can significantly ease your healthcare journey. It’s essential to compare benefits and costs to find a plan that fits your needs. Remember, the right coverage can safeguard your health and finances, ensuring peace of mind.

Start exploring your options today to secure your future health care.