Blue Cross Blue Shield insurance may cover weight loss surgery, but coverage varies by individual policy. Consult your specific BCBS plan details for eligibility and requirements related to bariatric procedures.

Understanding your health insurance coverage is crucial, particularly when considering major medical procedures like weight loss surgery. Blue Cross Blue Shield, a widely recognized insurance provider, offers plans that often include bariatric surgery coverage. Eligibility for this coverage typically hinges on specific medical criteria and policy guidelines.

Pre-approval is generally a requisite, along with documented evidence of previous weight loss attempts. Being well-informed about your BCBS policy can streamline the process of accessing necessary treatments for your health and well-being. It is essential to review and understand your individual policy or communicate directly with a BCBS representative to determine the extent of coverage for weight loss surgery under your plan.

Credit: jetmedicaltourism.com

Insurance And Weight Loss Surgery

Many people consider weight loss surgery to tackle obesity. Insurance plays a big role here. Blue Cross Blue Shield may cover such surgeries. This depends on several factors. Let’s dive into the specifics.

Coverage Scope By Blue Cross Blue Shield

Blue Cross Blue Shield offers different plans. Coverage for weight loss surgery varies. It often hinges on medical necessity. Your plan details are crucial.

- Gastric bypass may be covered

- Sleeve gastrectomy could qualify

- Laparoscopic banding might be an option

Each plan has unique terms. It’s essential to check your policy. Speak with a representative for clarity.

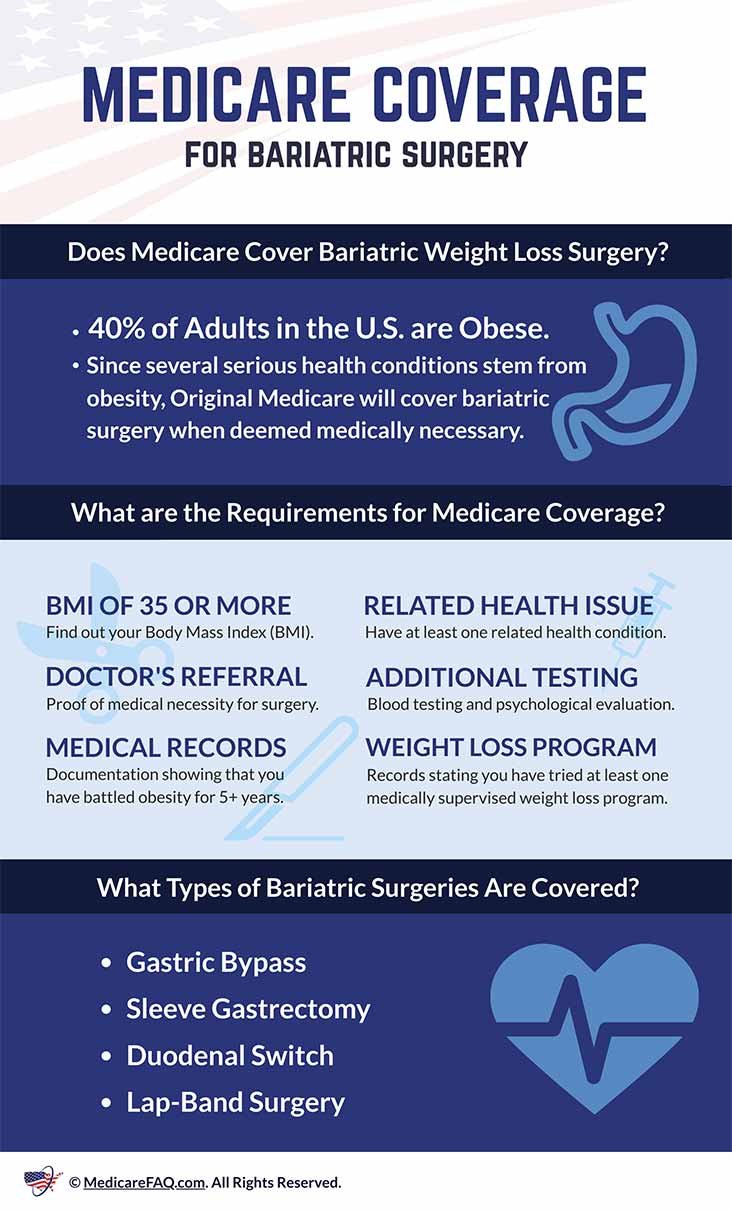

Pre-requisites For Surgery Approval

To get approval, certain conditions must be met. These pre-requisites ensure patient safety and need.

| Requirement | Description |

|---|---|

| BMI Criteria | A BMI over 40, or over 35 with complications. |

| Medical Evaluation | A doctor must confirm the surgery is medically necessary. |

| Documentation | Past weight loss attempts must be recorded. |

| Program Participation | Some plans require involvement in a weight loss program. |

A thorough assessment by your healthcare provider is needed. They’ll check if surgery is the best choice for you.

Always review the specifics of your insurance plan. This helps understand your coverage better. Also, remember to follow all the necessary steps for approval.

Bariatric Surgery Options

Exploring bariatric surgery options marks a pivotal step in the journey to better health. Various weight loss procedures exist, each tailored to the specific needs of the patient. Blue Cross Blue Shield insurance often provides coverage for these life-changing surgeries, but the types of procedures covered can vary.

Types Of Weight Loss Procedures

When considering bariatric surgery, it is important to understand the different types available. Each procedure has unique benefits and risks.

- Gastric Bypass: It divides the stomach into a small upper pouch and a larger lower remnant pouch.

- Sleeve Gastrectomy: A significant portion of the stomach is removed, creating a smaller “sleeve” shaped stomach.

- Adjustable Gastric Band: A band is placed around the upper part of the stomach to create a small pouch.

- Biliopancreatic Diversion with Duodenal Switch (BPD/DS): A complex procedure that removes a portion of the stomach and reroutes the small intestines.

Consultation with a healthcare provider will determine the best procedure based on health needs and goals.

Costs And Recovery Times

The cost of weight loss surgery can differ widely. Blue Cross Blue Shield may cover a significant portion, but details depend on the plan.

| Procedure | Average Cost (Without Insurance) | Recovery Time |

|---|---|---|

| Gastric Bypass | $23,000 | 2-4 weeks |

| Sleeve Gastrectomy | $19,000 | 2-4 weeks |

| Adjustable Gastric Band | $15,000 | 1 week |

| BPD/DS | $27,000 | 2-4 weeks |

Each surgery also has a recovery period ranging from one week to a month or more. Full benefits are often seen within one to two years post-surgery. Planning for both the financial and recovery aspects is key to a successful bariatric surgery journey.

Policy Variations By State

Policy Variations by State: The journey toward weight loss often leads to exploring surgical options. Blue Cross Blue Shield insurance may be a beacon of hope for those considering surgery. Yet, their coverage is not a one-size-fits-all plan. It’s crucial to recognize the policy variations by state. This look into individual state policies will clarify what to expect from your specific plan.

Differences In Coverage

Diving into the heart of the matter, coverage differences emerge prominently on a state-by-state basis. These differences are due to how each state regulates insurance providers and the packages they offer. Blue Cross Blue Shield tailors its plans according to state mandates and customer demographics. As such, what might be covered in one state may not be in another.

- Some states mandate coverage for weight loss surgery.

- Other states leave this decision to the insurance provider.

- Coverage may vary between gastric bypass, sleeve gastrectomy, and adjustable gastric banding.

State-specific Eligibility Criteria

While coverage variations exist, eligibility criteria can also be state-specific. Eligibility often hinges on factors like BMI, health conditions related to weight, and past attempts at weight loss. Here’s a snapshot of how state-specific criteria may present:

| State | BMI Requirement | Co-morbidity Conditions | Weight Loss History |

|---|---|---|---|

| California | ≥ 40 | Required | Documented efforts |

| Texas | ≥ 35 | Optional | 6-month program |

| Florida | ≥ 40 or ≥ 35 with conditions | Required | Doctor supervised diet |

Policies and criteria can change frequently. For the most current information, contact your Blue Cross Blue Shield representative in your state.

Navigating Blue Cross Blue Shield Policies

Navigating Blue Cross Blue Shield Policies can be complex. You may wonder about weight loss surgery coverage. Understanding your insurance plan is key. Blue Cross Blue Shield offers various policies, each with different coverage. Let’s explore what you need to know.

Documentation For Surgery Coverage

To confirm if your policy covers weight loss surgery, gather the right documents. You’ll need a detailed medical history. This helps show your need for surgery. Include records of past weight loss efforts. Insurance often requires evidence of previous attempts to lose weight without surgery.

- Medical records detailing your weight history

- Documentation proving past diet and exercise plans

- Letters from doctors recommending surgery

Assessment And Pre-approval Process

Blue Cross Blue Shield requires a thorough assessment. This ensures surgery is necessary for you. Your body mass index (BMI) and health conditions are critical factors. They often determine your eligibility.

- Verify your BMI meets the minimum requirement for coverage.

- Undergo a medical assessment to show weight impacts your health.

- Submit paperwork through your surgeon’s office for pre-approval.

Your doctor can assist through this process. Keep steady communication. Your insurer may ask for additional information. Be ready to provide any extra documentation quickly. This can help avoid delays in your approval.

The Pre-authorization Journey

Embarking on the weight loss surgery path can be life-changing. Understanding the pre-authorization journey with Blue Cross Blue Shield Insurance is critical.

The process requires time and effort. Following the right steps can clear the way for approval. Below are the stages involved in getting surgery authorized.

Steps For Getting Surgery Approved

- Check Blue Cross Blue Shield Insurance plan coverage. Not all plans are identical.

- Consult a certified bariatric surgeon within the network.

- Gather and submit the necessary medical documentation.

- Complete any required medical evaluations or tests.

- Engage in a medically supervised weight loss program, if necessary.

- Wait for the insurance provider’s authorization decision.

Documentation Required For Pre-authorization

Blue Cross Blue Shield demands specific documents. These support the need for surgery. Without them, authorization might fail.

| Type of Document | Description | Why It’s Needed |

|---|---|---|

| Medical history | Record of health issues and treatments | Shows long-term weight history |

| Physician’s statement | Doctor’s assessment | Professional opinion on surgery necessity |

| Nutritional evaluation | Dietary habits review | Assesses readiness for post-surgery diet |

| Psychological evaluation | Mental health assessment | Ensures psychological preparedness |

| Proof of participation | Evidence of a diet program attempt | Confirms commitment to lifestyle change |

Real Stories Of Coverage

When it comes to weight loss surgery coverage, real-life stories often paint the clearest picture. Blue Cross Blue Shield policyholders have diverse experiences based on their specific plans and medical necessities. Let’s delve into some personal accounts to understand what actual patients faced when seeking coverage for weight loss procedures.

Patient Experiences With Blue Cross Blue Shield

Many Blue Cross Blue Shield members have looked to their insurance for weight loss surgery support. Stories vary widely, from stress-free approvals to challenging denials. These accounts provide valuable insights for those considering a similar journey.

- John’s Quick Approval: A timely submission of medical records led to a hassle-free approval.

- Emma’s Persistent Effort: After initially being denied, her appeal with additional documentation turned the tide.

- Alex’s Criteria Challenges: Facing strict criteria for eligibility, Alex navigated multiple consultations to secure coverage.

Success And Denial Scenarios

Success stories are inspirational, but it’s important to also recognize when coverage isn’t granted. Here are some common scenarios:

| Scenario | Outcome |

|---|---|

| Complete Documentation | Leads to successful coverage for surgery. |

| Lack of Preoperative Efforts | May result in denial due to insufficient medical necessity. |

| Detailed Medical History | Supports the case, increasing the chance of approval. |

| Inadequate Insurance Plan | Leads to outright denial, regardless of health condition. |

Each story underscores the critical role of understanding your Blue Cross Blue Shield policy. Recruits the help of healthcare providers, and prepares a robust case. With the right approach, weight loss surgery can become a reality under Blue Cross Blue Shield coverage.

Alternatives And Supplements To Coverage

Exploring coverage for weight loss surgery can be daunting. Not all insurance policies offer full support for this life-changing procedure. Blue Cross Blue Shield may cover weight loss surgery, but limitations exist. It’s essential to consider alternate routes to manage these costs.

Financing Options Beyond Blue Cross Blue Shield

Funding your weight loss surgery without full insurance coverage is possible. Various financing options cater to different budget plans and financial situations.

- Medical Loans: Banks and financial institutions provide specific loans for healthcare needs at different interest rates.

- Payment Plans: Some surgical centers offer payment plans, allowing you to pay in installments over time.

- Health Savings Account (HSA): You could use pre-tax dollars saved in your HSA for eligible medical expenses.

- Flexible Spending Account (FSA): Similar to an HSA, an FSA allows for the use of pre-tax funds for certain procedures.

Additional Insurance And Discount Programs

If Blue Cross Blue Shield insurance cannot fully cover your surgery, look into additional options to reduce your out-of-pocket costs.

| Option | Description |

|---|---|

| Secondary Insurance | Acquiring a supplementary policy could cover gaps left by your primary insurer. |

| Employer Discounts | Some employers partner with healthcare providers to offer discounted rates. |

| Non-Profit Organizations | Organizations offer grants and aid for individuals seeking medical treatments. |

Remember, diligent research and conversations with financial counselors at medical facilities can uncover even more valuable resources.

Credit: jetmedicaltourism.com

Appealing A Denial

Understanding your insurance coverage for weight loss surgery can be tricky. If Blue Cross Blue Shield denies your claim, you have the right to appeal. This section guides you through understanding why insurance claims get rejected and how to challenge a denial effectively.

Grounds For Bariatric Surgery Claim Rejection

Several reasons can lead to a denial of your bariatric surgery coverage:

- Lack of medical necessity: Insurers require proof that surgery is essential for your health.

- Incomplete documentation: Submit every record needed. Missing information leads to rejection.

- Non-coverage of the procedure: Some plans don’t include weight loss surgery.

- Exclusions in policy: Review your policy. Ensure weight loss surgery isn’t excluded explicitly.

Steps To Challenge A Denial

Don’t lose hope if your claim is initially denied. Follow these steps to appeal:

- Review the denial letter: Understand the exact reason for denial.

- Collect supporting documents: Gather medical records and letters from your doctor.

- Contact customer service: Ask for clarity and the appeal process details.

- Prepare your appeal letter: Make it concise. State why you meet criteria for surgery.

- Submit the appeal: Follow the insurer’s guidelines. Send before the deadline.

- Seek assistance: Consider a lawyer or advocate if necessary.

Persistence is key. Stay organized and proactive throughout the appeal. Remember, every step you take brings you closer to the treatment you need.

Credit: healthnews.com

Frequently Asked Questions

How Long Does It Take Bcbs Federal To Approve Bariatric Surgery?

Approval time for bariatric surgery through BCBS Federal can vary, typically ranging from a few weeks to several months, depending on individual case complexity and required documentation.

Does Blue Cross Blue Shield Federal Cover Ozempic For Weight Loss?

Blue Cross Blue Shield Federal plans may cover Ozempic for weight loss if prescribed by a doctor, but coverage varies. Check your specific plan details or contact customer service for confirmation.

What Bmi Will Insurance Cover Weight Loss Surgery?

Insurance typically covers weight loss surgery for individuals with a BMI of 40 or higher, or 35 with obesity-related health conditions. Always check with your provider for specific coverage details.

Does Bcbsil Cover Weight Loss Surgery?

BCBSIL may cover weight loss surgery if it meets certain medical criteria. Coverage varies by plan, so check with BCBSIL directly for specific details.

Conclusion

Navigating the complexities of insurance coverage can be daunting. Thankfully, Blue Cross Blue Shield recognizes the health benefits of weight loss surgery for eligible candidates. If your policy includes bariatric surgery, this could be a transformative step towards a healthier you.

Always consult with your provider to understand your specific coverage and start your journey with confidence.